Mar. 21st 2025

QQQ posts first up week since start of downtrend

Market Signal: -2 WEAK BEARISH

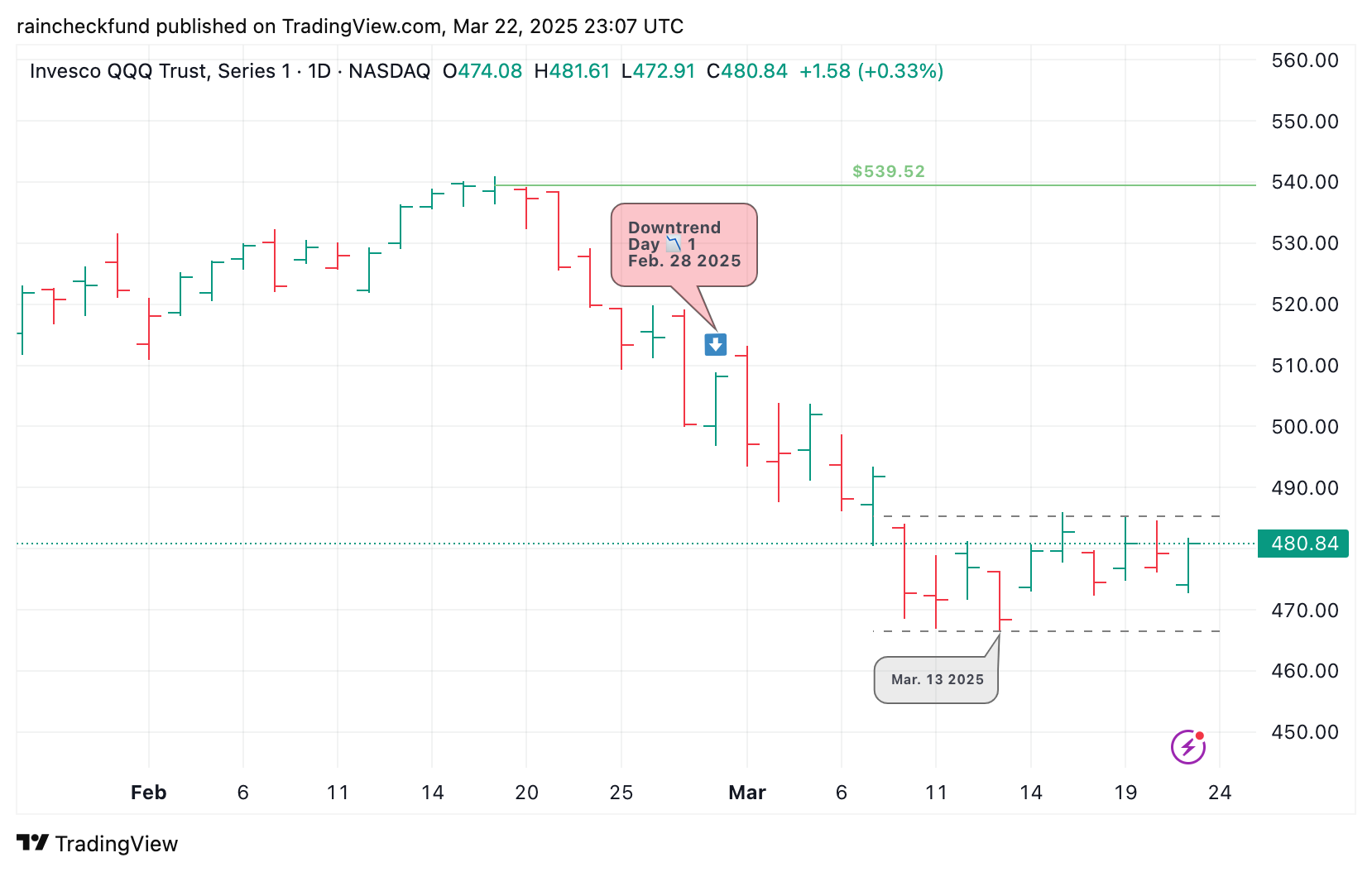

The downtrend appeared to weaken a bit, as the Market Signal went from -3 to -2 this week. QQQ posted its first up week since day 📉1 of the current downtrend (Feb. 28th 2025).

On Mar. 13th 2025 QQQ closed -13.19% below its YTD highest close. Since then, QQQ has begun to form a range. Tight price action to end the week; QQQ closed within 0.32% of the prior close for the last 3 consecutive days.

QQQ begins to form a range after having fell -13.19% from its YTD high of $539.52NASDAQ-100 52-week lows

The following NASDAQ-100 (QQQ) holdings closed at a 52-week low today:

REGN $658.48 -0.62%NXPI $200.64 -0.99%

SQQQ (the inverse triple-leveraged (-3x) ETF for the NASDAQ-100) will be used in place of TQQQ in the next two sections benchmarking against QQQ and its holdings.📉16th day of downtrend

Day 📉1 of current downtrend occurred on Fri. Feb. 28th 2025.

QQQ-5.38% since start of current downtrendSQQQ+15.92% since start of current downtrend

| A | B | C | D | E | F | G | |

|---|---|---|---|---|---|---|---|

|

1

|

Market Signal | Trend Count | QQQ Close | QQQ %chg since 📉1 | SQQQ close | SQQQ %chg since 📉1 | Date |

|

2

|

-2 | 📉1 | $508.17 | 0.00% | $31.40 | 0.00% | Fri 2/28/25 |

|

3

|

-3 | 📉2 | $497.05 | -2.19% | $33.43 | 6.46% | Mon 3/3/25 |

|

4

|

-3 | 📉3 | $495.55 | -2.48% | $33.81 | 7.68% | Tue 3/4/25 |

|

5

|

-3 | 📉4 | $502.01 | -1.21% | $32.51 | 3.54% | Wed 3/5/25 |

|

6

|

-3 | 📉5 | $488.20 | -3.93% | $35.17 | 12.01% | Thu 3/6/25 |

|

7

|

-3 | 📉6 | $491.79 | -3.22% | $34.47 | 9.78% | Fri 3/7/25 |

|

8

|

-3 | 📉7 | $472.73 | -6.97% | $38.37 | 22.20% | Mon 3/10/25 |

|

9

|

-3 | 📉8 | $471.60 | -7.20% | $38.80 | 23.57% | Tue 3/11/25 |

|

10

|

-3 | 📉9 | $476.92 | -6.15% | $37.49 | 19.39% | Wed 3/12/25 |

|

11

|

-3 | 📉10 | $468.34 | -7.84% | $39.54 | 25.92% | Thu 3/13/25 |

|

12

|

-3 | 📉11 | $479.66 | -5.61% | $36.73 | 16.97% | Fri 3/14/25 |

|

13

|

-3 | 📉12 | $482.77 | -5.00% | $36.02 | 14.71% | Mon 3/17/25 |

|

14

|

-3 | 📉13 | $474.54 | -6.62% | $37.84 | 20.51% | Tue 3/18/25 |

|

15

|

-2 | 📉14 | $480.89 | -5.37% | $36.40 | 15.92% | Wed 3/19/25 |

|

16

|

-2 | 📉15 | $479.26 | -5.69% | $36.75 | 17.04% | Thu 3/20/25 |

|

17

|

-2 | 📉16 | $480.84 | -5.38% | $36.40 | 15.92% | Fri 3/21/25 |

Market Signal, Trend Count, closing prices, and return (%) over current downtrend

SQQQ vs QQQ Holdings

SQQQ is outperforming 99% of QQQ holdings since day 📉1 of current downtrend (Feb. 28th 2025).

Other than MSTR, which is essentially a bitcoin play, SQQQ has outperformed TQQQ, QQQ, and all of QQQ's holdings since day 📉1 of current downtrend.

An SQQQ position opened at close on day 📉1 of current downtrend (per Raincheck Fund's strategy) has outperformed QQQ by +21.3% since then.

| A | B | C | D | E | |

|---|---|---|---|---|---|

|

1

|

Market Cap | Symbol | %Chg since 📉1 | Close on 📉1 | Close |

|

2

|

174,425 M | QQQ | -5.38% | $508.17 | $480.84 |

|

3

|

79,167 M | MSTR | 19.01% | $255.43 | $304.00 |

|

4

|

1,256 M | SQQQ | 15.92% | $31.40 | $36.40 |

|

5

|

37,607 M | EA | 11.76% | $129.12 | $144.30 |

|

6

|

175,874 M | PDD | 11.39% | $113.69 | $126.64 |

|

7

|

213,334 M | PLTR | 7.11% | $84.92 | $90.96 |

|

8

|

172,484 M | AMD | 6.59% | $99.86 | $106.44 |

|

9

|

43,490 M | AXON | 5.97% | $528.45 | $560.00 |

|

10

|

129,217 M | VRTX | 4.88% | $479.79 | $503.20 |

|

11

|

55,772 M | MNST | 4.87% | $54.65 | $57.31 |

|

12

|

71,931 M | CDNS | 4.76% | $250.50 | $262.42 |

|

13

|

31,750 M | ZS | 4.57% | $196.23 | $205.20 |

|

14

|

33,092 M | CSGP | 2.90% | $76.25 | $78.46 |

|

15

|

169,778 M | AMGN | 2.59% | $308.06 | $316.04 |

|

16

|

138,953 M | CMCSA | 2.42% | $35.88 | $36.75 |

|

17

|

105,046 M | INTC | 2.23% | $23.73 | $24.26 |

|

18

|

105,856 M | MU | 1.16% | $93.63 | $94.72 |

|

19

|

281,618 M | ASML | 1.01% | $709.08 | $716.22 |

|

20

|

37,677 M | TTWO | 0.70% | $211.98 | $213.47 |

|

21

|

83,445 M | MDLZ | 0.44% | $64.23 | $64.51 |

|

22

|

20,624 M | BIIB | 0.28% | $140.50 | $140.90 |

|

23

|

45,519 M | KDP | 0.09% | $33.52 | $33.55 |

|

24

|

51,666 M | CHTR | 0.07% | $363.57 | $363.81 |

|

25

|

173,443 M | QCOM | -0.22% | $157.17 | $156.82 |

|

26

|

45,876 M | FANG | -0.29% | $158.96 | $158.50 |

|

27

|

93,883 M | KLAC | -0.33% | $708.84 | $706.49 |

|

28

|

21,359 M | GFS | -0.36% | $38.77 | $38.63 |

|

29

|

56,096 M | AEP | -0.89% | $106.05 | $105.11 |

|

30

|

44,218 M | EXC | -0.90% | $44.20 | $43.80 |

|

31

|

43,674 M | BKR | -1.08% | $44.59 | $44.11 |

|

32

|

97,353 M | LRCX | -1.17% | $76.74 | $75.84 |

|

33

|

69,435 M | PYPL | -1.21% | $71.05 | $70.19 |

|

34

|

106,225 M | MELI | -1.25% | $2,121.87 | $2,095.27 |

|

35

|

136,561 M | HON | -1.30% | $212.89 | $210.12 |

|

36

|

42,854 M | FAST | -1.32% | $75.73 | $74.73 |

|

37

|

2,908,620 M | MSFT | -1.44% | $396.99 | $391.26 |

|

38

|

39,043 M | CCEP | -1.55% | $86.26 | $84.92 |

|

39

|

168,867 M | INTU | -1.60% | $613.84 | $604.04 |

|

40

|

232,308 M | AZN | -1.68% | $76.21 | $74.93 |

|

41

|

216,750 M | LIN | -1.87% | $467.05 | $458.33 |

|

42

|

69,363 M | SNPS | -1.90% | $457.28 | $448.60 |

|

43

|

410,771 M | NFLX | -2.07% | $980.56 | $960.29 |

|

44

|

61,444 M | ROP | -2.11% | $584.50 | $572.18 |

|

45

|

51,812 M | CPRT | -2.14% | $54.80 | $53.63 |

|

46

|

76,693 M | ORLY | -2.52% | $1,373.64 | $1,339.09 |

|

47

|

56,924 M | ADSK | -2.54% | $274.21 | $267.25 |

|

48

|

28,417 M | ANSS | -2.72% | $333.25 | $324.20 |

|

49

|

2,026,588 M | GOOG | -3.47% | $172.22 | $166.25 |

|

50

|

106,757 M | APP | -3.59% | $325.74 | $314.03 |

|

51

|

1,999,038 M | GOOGL | -3.69% | $170.28 | $163.99 |

|

52

|

34,238 M | IDXX | -3.69% | $437.11 | $420.99 |

|

53

|

123,589 M | AMAT | -3.76% | $158.07 | $152.12 |

|

54

|

35,276 M | KHC | -3.87% | $30.71 | $29.52 |

|

55

|

901,175 M | AVGO | -3.90% | $199.43 | $191.66 |

|

56

|

80,079 M | DASH | -3.94% | $198.44 | $190.62 |

|

57

|

40,001 M | VRSK | -3.96% | $296.91 | $285.16 |

|

58

|

39,707 M | XEL | -4.15% | $72.10 | $69.11 |

|

59

|

120,714 M | PANW | -4.26% | $190.43 | $182.32 |

|

60

|

292,104 M | TMUS | -5.14% | $269.69 | $255.84 |

|

61

|

199,485 M | PEP | -5.23% | $153.47 | $145.45 |

|

62

|

66,364 M | WDAY | -5.26% | $263.34 | $249.49 |

|

63

|

51,496 M | PAYX | -5.70% | $151.67 | $143.02 |

|

64

|

71,988 M | REGN | -5.76% | $698.74 | $658.48 |

|

65

|

2,871,880 M | NVDA | -5.78% | $124.92 | $117.70 |

|

66

|

239,891 M | CSCO | -5.94% | $64.11 | $60.30 |

|

67

|

26,364 M | WBD | -6.28% | $11.46 | $10.74 |

|

68

|

120,157 M | ADP | -6.30% | $315.18 | $295.32 |

|

69

|

133,352 M | GILD | -6.32% | $114.31 | $107.08 |

|

70

|

35,117 M | ODFL | -6.39% | $176.50 | $165.22 |

|

71

|

37,265 M | GEHC | -6.71% | $87.35 | $81.49 |

|

72

|

50,886 M | NXPI | -6.93% | $215.59 | $200.64 |

|

73

|

18,450 M | ON | -6.95% | $47.05 | $43.78 |

|

74

|

89,790 M | CRWD | -7.04% | $389.66 | $362.24 |

|

75

|

21,937 M | CDW | -7.09% | $178.20 | $165.57 |

|

76

|

80,029 M | ABNB | -7.25% | $138.87 | $128.80 |

|

77

|

2,079,380 M | AMZN | -7.57% | $212.28 | $196.21 |

|

78

|

56,024 M | CSX | -7.62% | $32.01 | $29.57 |

|

79

|

77,145 M | CTAS | -7.87% | $207.50 | $191.17 |

|

80

|

151,516 M | BKNG | -7.95% | $5,016.01 | $4,617.26 |

|

81

|

37,799 M | CTSH | -8.29% | $83.33 | $76.42 |

|

82

|

75,859 M | FTNT | -8.67% | $108.01 | $98.65 |

|

83

|

162,875 M | TXN | -8.67% | $195.99 | $179.00 |

|

84

|

50,976 M | PCAR | -9.45% | $107.24 | $97.11 |

|

85

|

125,500 M | ARM | -9.58% | $131.69 | $119.07 |

|

86

|

3,278,868 M | AAPL | -9.75% | $241.84 | $218.27 |

|

87

|

36,001 M | DDOG | -9.88% | $116.55 | $105.03 |

|

88

|

1,510,694 M | META | -10.77% | $668.20 | $596.25 |

|

89

|

101,378 M | ADI | -11.15% | $230.06 | $204.40 |

|

90

|

69,705 M | CEG | -11.20% | $250.55 | $222.48 |

|

91

|

168,418 M | ADBE | -11.70% | $438.56 | $387.26 |

|

92

|

39,290 M | LULU | -11.76% | $365.61 | $322.62 |

|

93

|

40,759 M | ROST | -11.96% | $140.32 | $123.54 |

|

94

|

27,816 M | MCHP | -12.13% | $58.86 | $51.72 |

|

95

|

403,424 M | COST | -13.29% | $1,048.61 | $909.26 |

|

96

|

176,447 M | ISRG | -14.07% | $573.15 | $492.49 |

|

97

|

799,980 M | TSLA | -15.11% | $292.98 | $248.71 |

|

98

|

65,475 M | MAR | -15.32% | $280.45 | $237.49 |

|

99

|

110,265 M | SBUX | -16.18% | $115.81 | $97.07 |

|

100

|

28,839 M | DXCM | -16.49% | $88.37 | $73.80 |

|

101

|

27,935 M | TTD | -19.92% | $70.32 | $56.31 |

|

102

|

59,563 M | TEAM | -20.02% | $284.26 | $227.34 |

|

103

|

60,962 M | MRVL | -23.34% | $91.82 | $70.39 |

|

104

|

15,632 M | MDB | -28.00% | $267.43 | $192.54 |