Why TQQQ?

TQQQ during uptrends beats a majority of stocks? Subscribe to access the Market Signal for the current trend.

Raincheck Fund focuses on TQQQ (the triple-leveraged (+3x) ETF for the NASDAQ-100) because during uptrends TQQQ often outperforms a majority of the stocks in the NASDAQ-100, including the Magnificent Seven.

It’s no secret that in years past, the returns of the NASDAQ-100 (QQQ) and the S&P 500 (SPY) have been driven mostly by the Magnificent Seven (GOOG/GOOGL, AMZN, AAPL, META, MSFT, NVDA, TSLA).

The 10 largest U.S. companies accounted for 14% of the S&P 500 stock index a decade ago, 27% of the index at the end of 2023, and 37% of the index as of June 24 2024 [1]

- The "Magnificent 7" mega-stocks account for over a third of the total weighting in the S&P 500, but the comprising 8 tickers make up only 1.6% of the 500 stocks in the index. [2]

- The issue is even more apparent in NASDAQ-100 (

QQQ), where the Magnificent Seven make up nearly 50% of the total weighting.

To put the outperformance of the Magnificent 7 stocks in perspective, consider the following:

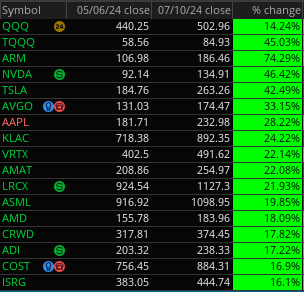

Consider the performance of TQQQ, QQQ, and it's holdings from the first day of an uptrend on Mon. May 6 2024, through Wed. July 10 2024, as shown below:

Left: TQQQ out performs 98% of QQQ stocks (all but ARM and NVDA) from 5/6/24 to 7/10/24 uptrend. Right: QQQ chart over same timeframe.

Notice that during this time TQQQ outperformed every stock in QQQ, except for ARM and NVDA. TQQQ outperformed 98 out of 100 (or 98%) of stocks in QQQ during this uptrend.

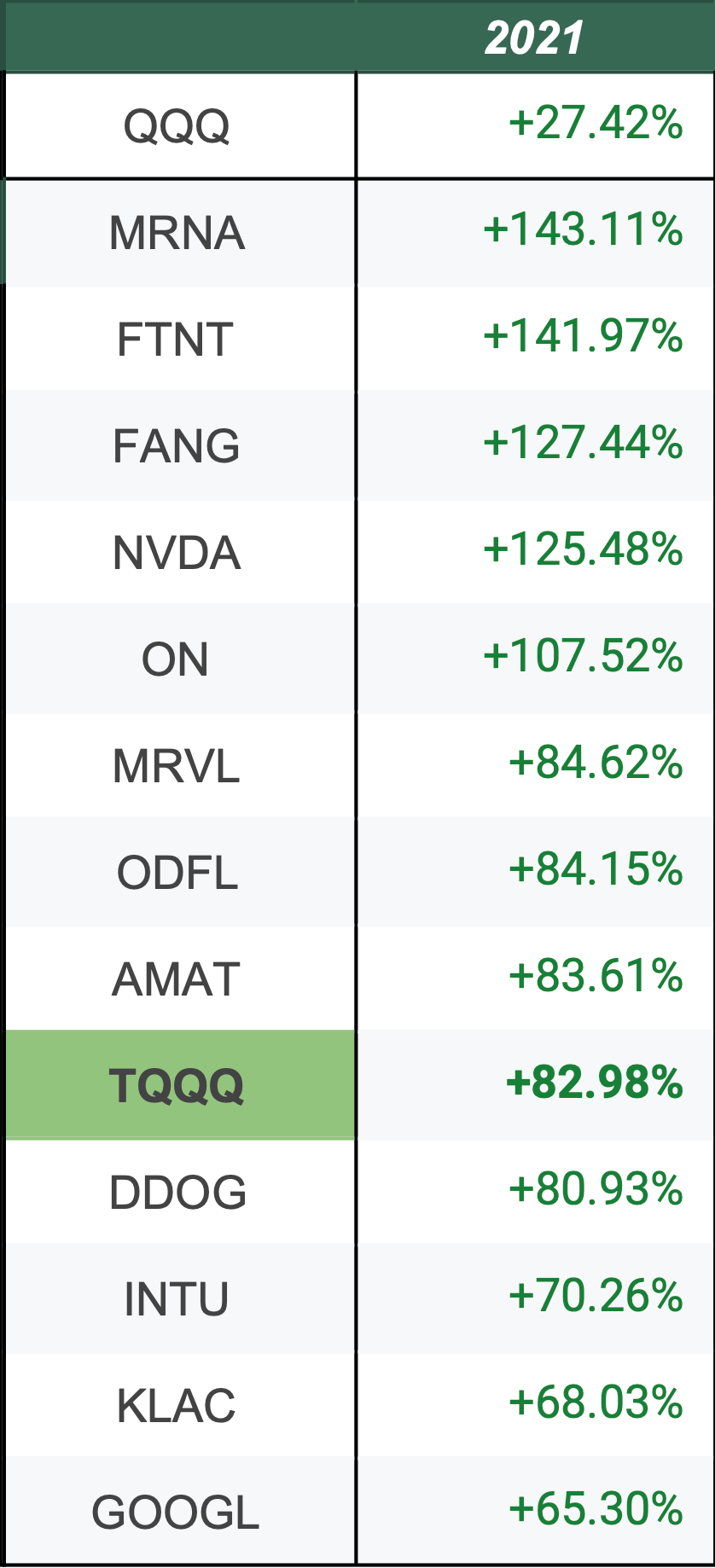

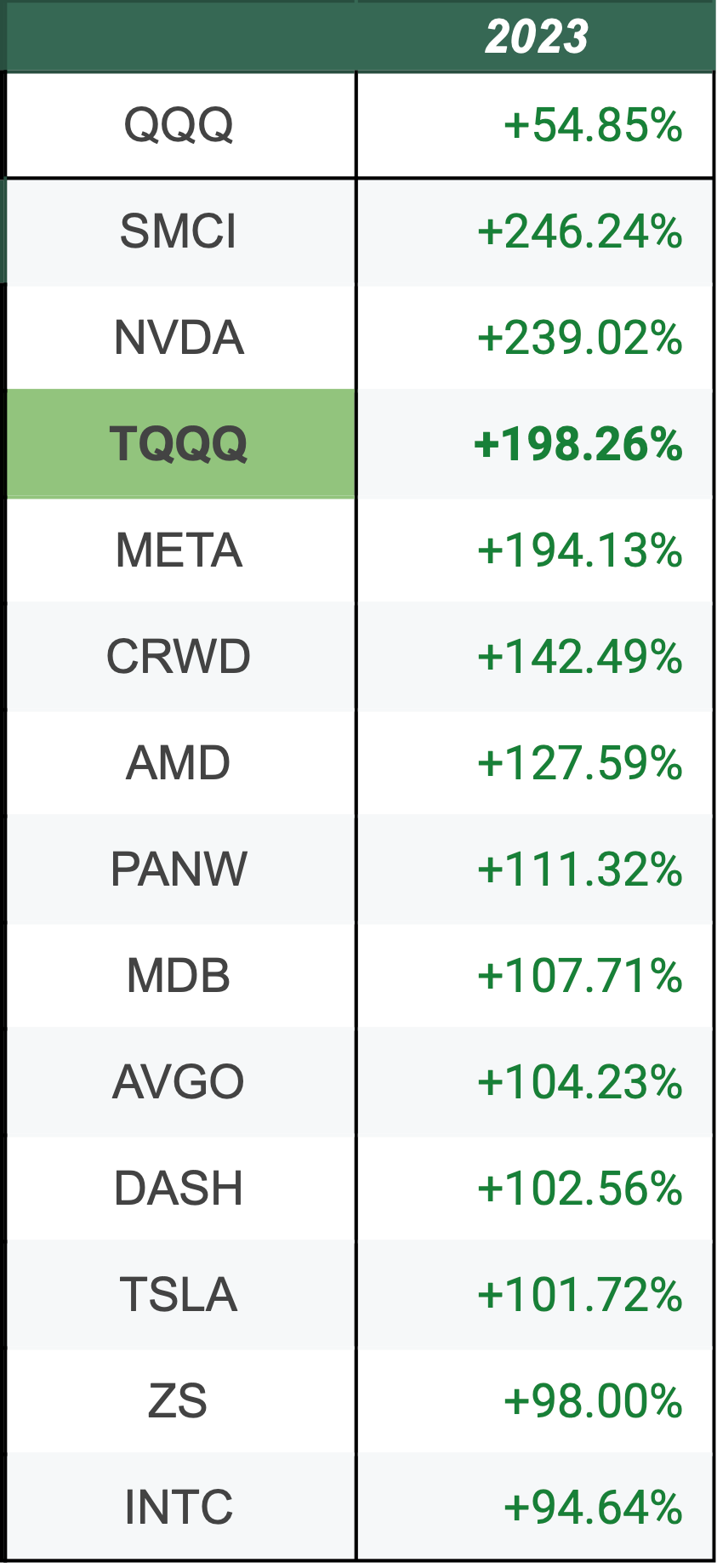

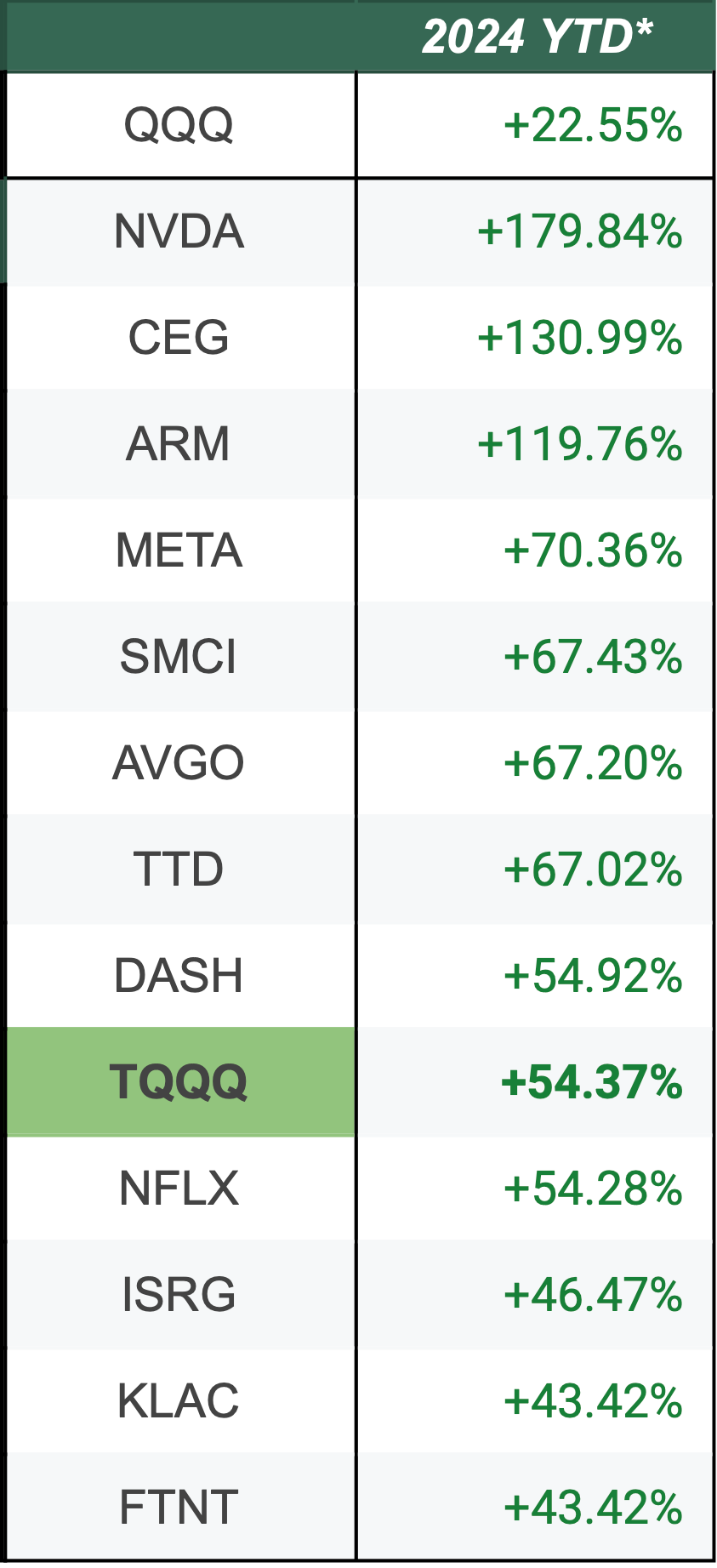

This pattern is seen time and again. Consider returns for TQQQ vs the 15 top performing holdings in QQQ during 2020, 2021, 2023, 2024, and the trailing past 5 years, shown below.

Note: 2022 is excluded from below table as the Market Signal was negative for a majority of the year (see above 'in cash during downtrends').

Disclaimer: The information that Raincheck Fund provides is general in nature as it has been prepared without taking account of your objectives, financial situation or needs. It is not intended as legal, financial or investment advice and should not be construed or relied on as such. Raincheck Fund is for information purposes only. Raincheck Fund is not responsible for any damages or losses that may occur as a result of reliance on this information. Before making any commitment of a legal or financial nature you should seek advice from a qualified and registered legal practitioner or financial or investment adviser.

All content, group, messaging, tweets, newsletter, article, and email created by Raincheck Fund is intended for educational and information purposes only, is not financial, investment, legal or tax advice, and is a restatement, summary or extract of other data and research reports that are widely distributed and publicly available. Raincheck Fund is not a registered financial, investment, legal or tax advisor and is not liable for any financial loss you may incur acting on any information provided by Raincheck Fund.

Investment advice provided solely by Autopilot advisers LLC, an SEC registered investment advisor. Past performance does not guarantee future results. Investing carries risks, including the risk of the loss of principal.

Investing in securities involves significant risk, including the risk of loss of principal. Past performance does not guarantee future results, and there can be no assurance that any investment strategy or security will meet its objectives or achieve any specific financial outcome. You should only invest risk capital that you can afford to lose without impacting your financial stability. Carefully consider your individual financial situation, investment goals, and risk tolerance before making any investment decisions.