Aug. 29th 2025

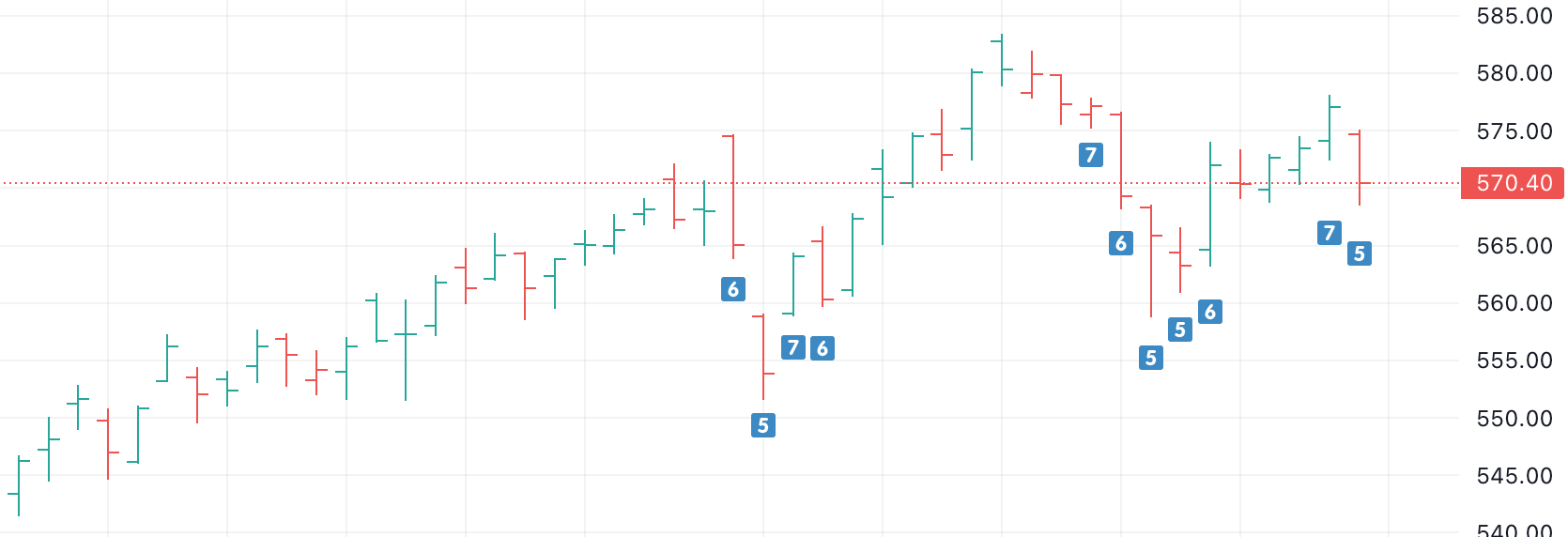

Uptrend under pressure

Market Signal: +5 MODERATE BULLISH

The Market Signal has now blipped out of STRONG BULLISH range into MODERATE BULLISH range thrice in the last 22 trading days, and twice in the past two weeks.

Unlike last week, this week ended on a sour note; the NASDAQ-100 (QQQ) fell -1.16%.

STRONG BULLISH range, the Market Signal has blipped into MODERATE BULLISH range thrice in the last 22 trading daysAfter a strong run, the NASDAQ-100 (QQQ) is experiencing choppiness. The specter of macroeconomic forces loom large. The current uptrend seems to be in jeopardy. If we don't see some upward action and a breakout to new highs it may conclude.

NASDAQ-100 52-week highs

The following NASDAQ-100 (QQQ) holdings closed at a 52-week high today:

GOOG $213.53 +0.55%GOOGL $212.91 +0.60%

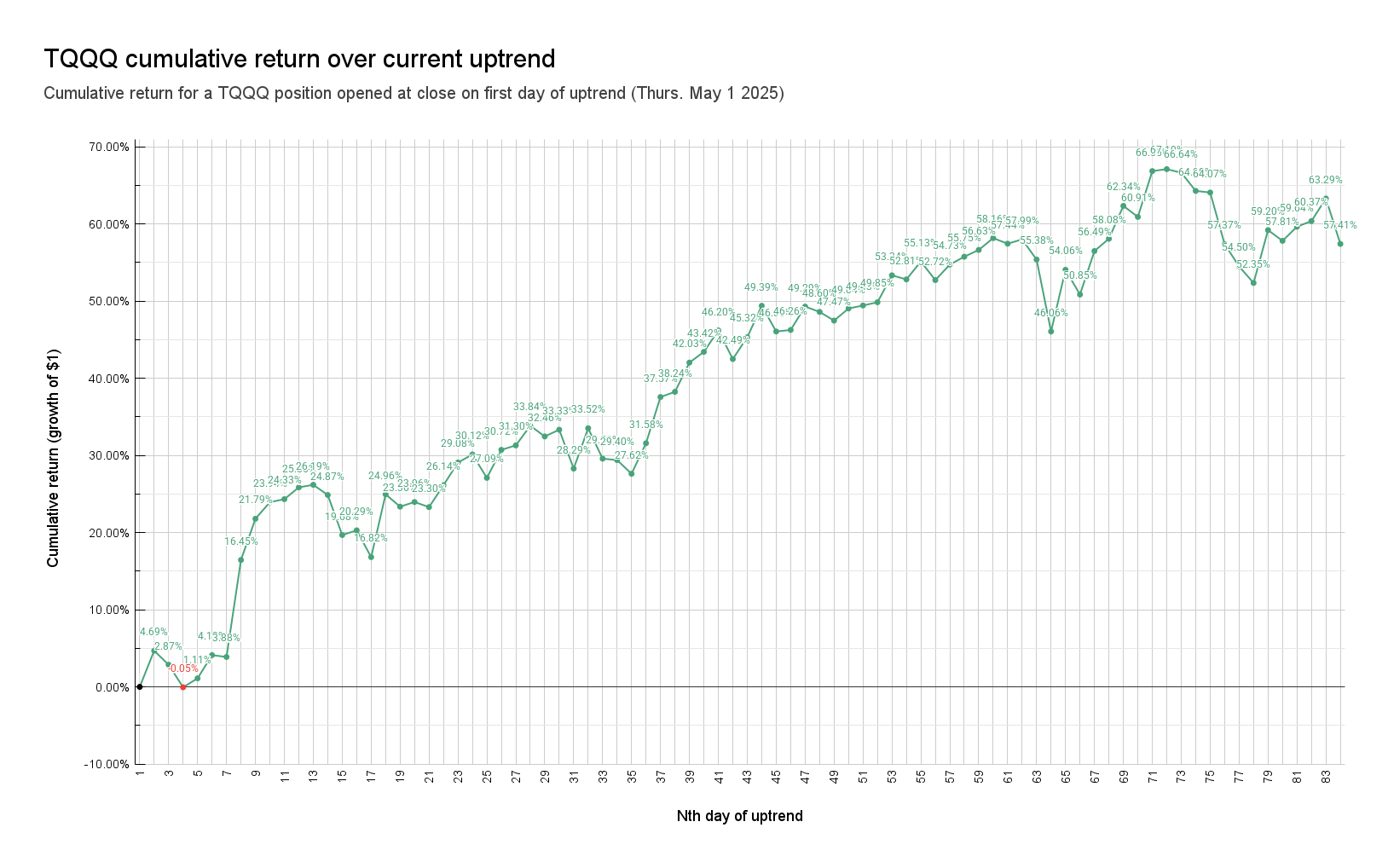

📈84th day of uptrend

Day 📈1 of current uptrend occurred on Thurs. May 1st 2025.

QQQ+18.42% since start of current uptrendTQQQ+57.41% since start of current uptrend

| A | B | C | D | E | F | G | |

|---|---|---|---|---|---|---|---|

|

1

|

Market Signal | Trend Count | QQQ Close | QQQ %chg since 📈1 | TQQQ close | TQQQ %chg since 📈1 | Date |

|

2

|

2 | 📈1 | $481.68 | 0.00% | $56.77 | 0.00% | Thu 5/1/25 |

|

3

|

2 | 📈2 | $488.83 | 1.48% | $59.43 | 4.69% | Fri 5/2/25 |

|

4

|

2 | 📈3 | $485.93 | 0.88% | $58.40 | 2.87% | Mon 5/5/25 |

|

5

|

2 | 📈4 | $481.41 | -0.06% | $56.74 | -0.05% | Tue 5/6/25 |

|

6

|

2 | 📈5 | $483.30 | 0.34% | $57.40 | 1.11% | Wed 5/7/25 |

|

7

|

2 | 📈6 | $488.29 | 1.37% | $59.11 | 4.12% | Thu 5/8/25 |

|

8

|

2 | 📈7 | $487.97 | 1.31% | $58.97 | 3.88% | Fri 5/9/25 |

|

9

|

3 | 📈8 | $507.85 | 5.43% | $66.11 | 16.45% | Mon 5/12/25 |

|

10

|

3 | 📈9 | $515.59 | 7.04% | $69.14 | 21.79% | Tue 5/13/25 |

|

11

|

3 | 📈10 | $518.68 | 7.68% | $70.36 | 23.94% | Wed 5/14/25 |

|

12

|

3 | 📈11 | $519.25 | 7.80% | $70.58 | 24.33% | Thu 5/15/25 |

|

13

|

3 | 📈12 | $521.51 | 8.27% | $71.45 | 25.86% | Fri 5/16/25 |

|

14

|

3 | 📈13 | $522.01 | 8.37% | $71.64 | 26.19% | Mon 5/19/25 |

|

15

|

3 | 📈14 | $520.27 | 8.01% | $70.89 | 24.87% | Tue 5/20/25 |

|

16

|

3 | 📈15 | $513.04 | 6.51% | $67.94 | 19.68% | Wed 5/21/25 |

|

17

|

2 | 📈16 | $514.00 | 6.71% | $68.29 | 20.29% | Thu 5/22/25 |

|

18

|

2 | 📈17 | $509.24 | 5.72% | $66.32 | 16.82% | Fri 5/23/25 |

|

19

|

4 | 📈18 | $521.22 | 8.21% | $70.94 | 24.96% | Tue 5/27/25 |

|

20

|

3 | 📈19 | $518.91 | 7.73% | $70.03 | 23.36% | Wed 5/28/25 |

|

21

|

3 | 📈20 | $519.93 | 7.94% | $70.37 | 23.96% | Thu 5/29/25 |

|

22

|

3 | 📈21 | $519.11 | 7.77% | $70.00 | 23.30% | Fri 5/30/25 |

|

23

|

4 | 📈22 | $523.21 | 8.62% | $71.61 | 26.14% | Mon 6/2/25 |

|

24

|

4 | 📈23 | $527.30 | 9.47% | $73.28 | 29.08% | Tue 6/3/25 |

|

25

|

3 | 📈24 | $528.77 | 9.78% | $73.87 | 30.12% | Wed 6/4/25 |

|

26

|

3 | 📈25 | $524.79 | 8.95% | $72.15 | 27.09% | Thu 6/5/25 |

|

27

|

4 | 📈26 | $529.92 | 10.01% | $74.21 | 30.72% | Fri 6/6/25 |

|

28

|

3 | 📈27 | $530.70 | 10.18% | $74.54 | 31.30% | Mon 6/9/25 |

|

29

|

3 | 📈28 | $534.21 | 10.91% | $75.98 | 33.84% | Tue 6/10/25 |

|

30

|

3 | 📈29 | $532.41 | 10.53% | $75.20 | 32.46% | Wed 6/11/25 |

|

31

|

3 | 📈30 | $533.66 | 10.79% | $75.69 | 33.33% | Thu 6/12/25 |

|

32

|

2 | 📈31 | $526.96 | 9.40% | $72.83 | 28.29% | Fri 6/13/25 |

|

33

|

3 | 📈32 | $534.29 | 10.92% | $75.80 | 33.52% | Mon 6/16/25 |

|

34

|

2 | 📈33 | $529.08 | 9.84% | $73.56 | 29.58% | Tue 6/17/25 |

|

35

|

2 | 📈34 | $528.99 | 9.82% | $73.46 | 29.40% | Wed 6/18/25 |

|

36

|

2 | 📈35 | $526.83 | 9.37% | $72.45 | 27.62% | Fri 6/20/25 |

|

37

|

7 | 📈36 | $531.65 | 10.37% | $74.70 | 31.58% | Mon 6/23/25 |

|

38

|

7 | 📈37 | $539.78 | 12.06% | $78.10 | 37.57% | Tue 6/24/25 |

|

39

|

7 | 📈38 | $541.16 | 12.35% | $78.48 | 38.24% | Wed 6/25/25 |

|

40

|

8 | 📈39 | $546.22 | 13.40% | $80.63 | 42.03% | Thu 6/26/25 |

|

41

|

7 | 📈40 | $548.09 | 13.79% | $81.42 | 43.42% | Fri 6/27/25 |

|

42

|

8 | 📈41 | $551.64 | 14.52% | $83.00 | 46.20% | Mon 6/30/25 |

|

43

|

7 | 📈42 | $546.99 | 13.56% | $80.89 | 42.49% | Tue 7/1/25 |

|

44

|

7 | 📈43 | $550.80 | 14.35% | $82.50 | 45.32% | Wed 7/2/25 |

|

45

|

8 | 📈44 | $556.22 | 15.48% | $84.81 | 49.39% | Thu 7/3/25 |

|

46

|

7 | 📈45 | $552.03 | 14.61% | $82.92 | 46.06% | Mon 7/7/25 |

|

47

|

7 | 📈46 | $552.34 | 14.67% | $83.03 | 46.26% | Tue 7/8/25 |

|

48

|

7 | 📈47 | $556.25 | 15.48% | $84.75 | 49.29% | Wed 7/9/25 |

|

49

|

7 | 📈48 | $555.45 | 15.32% | $84.36 | 48.60% | Thu 7/10/25 |

|

50

|

7 | 📈49 | $554.20 | 15.06% | $83.72 | 47.47% | Fri 7/11/25 |

|

51

|

7 | 📈50 | $556.21 | 15.47% | $84.61 | 49.04% | Mon 7/14/25 |

|

52

|

7 | 📈51 | $556.72 | 15.58% | $84.83 | 49.43% | Tue 7/15/25 |

|

53

|

7 | 📈52 | $557.29 | 15.70% | $85.07 | 49.85% | Wed 7/16/25 |

|

54

|

7 | 📈53 | $561.80 | 16.63% | $87.05 | 53.34% | Thu 7/17/25 |

|

55

|

7 | 📈54 | $561.26 | 16.52% | $86.75 | 52.81% | Fri 7/18/25 |

|

56

|

7 | 📈55 | $564.17 | 17.13% | $88.07 | 55.13% | Mon 7/21/25 |

|

57

|

7 | 📈56 | $561.25 | 16.52% | $86.70 | 52.72% | Tue 7/22/25 |

|

58

|

7 | 📈57 | $563.81 | 17.05% | $87.84 | 54.73% | Wed 7/23/25 |

|

59

|

7 | 📈58 | $565.01 | 17.30% | $88.42 | 55.75% | Thu 7/24/25 |

|

60

|

7 | 📈59 | $566.37 | 17.58% | $88.92 | 56.63% | Fri 7/25/25 |

|

61

|

7 | 📈60 | $568.14 | 17.95% | $89.79 | 58.16% | Mon 7/28/25 |

|

62

|

7 | 📈61 | $567.26 | 17.77% | $89.38 | 57.44% | Tue 7/29/25 |

|

63

|

7 | 📈62 | $568.02 | 17.92% | $89.69 | 57.99% | Wed 7/30/25 |

|

64

|

6 | 📈63 | $565.01 | 17.30% | $88.21 | 55.38% | Thu 7/31/25 |

|

65

|

5 | 📈64 | $553.88 | 14.99% | $82.92 | 46.06% | Fri 8/1/25 |

|

66

|

7 | 📈65 | $564.10 | 17.11% | $87.46 | 54.06% | Mon 8/4/25 |

|

67

|

6 | 📈66 | $560.27 | 16.32% | $85.64 | 50.85% | Tue 8/5/25 |

|

68

|

7 | 📈67 | $567.32 | 17.78% | $88.84 | 56.49% | Wed 8/6/25 |

|

69

|

7 | 📈68 | $569.24 | 18.18% | $89.74 | 58.08% | Thu 8/7/25 |

|

70

|

7 | 📈69 | $574.55 | 19.28% | $92.16 | 62.34% | Fri 8/8/25 |

|

71

|

7 | 📈70 | $572.85 | 18.93% | $91.35 | 60.91% | Mon 8/11/25 |

|

72

|

7 | 📈71 | $580.05 | 20.42% | $94.72 | 66.85% | Tue 8/12/25 |

|

73

|

7 | 📈72 | $580.34 | 20.48% | $94.86 | 67.10% | Wed 8/13/25 |

|

74

|

7 | 📈73 | $579.89 | 20.39% | $94.60 | 66.64% | Thu 8/14/25 |

|

75

|

7 | 📈74 | $577.34 | 19.86% | $93.26 | 64.28% | Fri 8/15/25 |

|

76

|

7 | 📈75 | $577.11 | 19.81% | $93.14 | 64.07% | Mon 8/18/25 |

|

77

|

6 | 📈76 | $569.28 | 18.19% | $89.34 | 57.37% | Tue 8/19/25 |

|

78

|

5 | 📈77 | $565.90 | 17.48% | $87.71 | 54.50% | Wed 8/20/25 |

|

79

|

5 | 📈78 | $563.28 | 16.94% | $86.49 | 52.35% | Thu 8/21/25 |

|

80

|

6 | 📈79 | $571.97 | 18.74% | $90.38 | 59.20% | Fri 8/22/25 |

|

81

|

6 | 📈80 | $570.32 | 18.40% | $89.59 | 57.81% | Mon 8/25/25 |

|

82

|

6 | 📈81 | $572.61 | 18.88% | $90.63 | 59.64% | Tue 8/26/25 |

|

83

|

7 | 📈82 | $573.49 | 19.06% | $91.04 | 60.37% | Wed 8/27/25 |

|

84

|

7 | 📈83 | $577.08 | 19.81% | $92.70 | 63.29% | Thu 8/28/25 |

|

85

|

5 | 📈84 | $570.40 | 18.42% | $89.36 | 57.41% | Fri 8/29/25 |

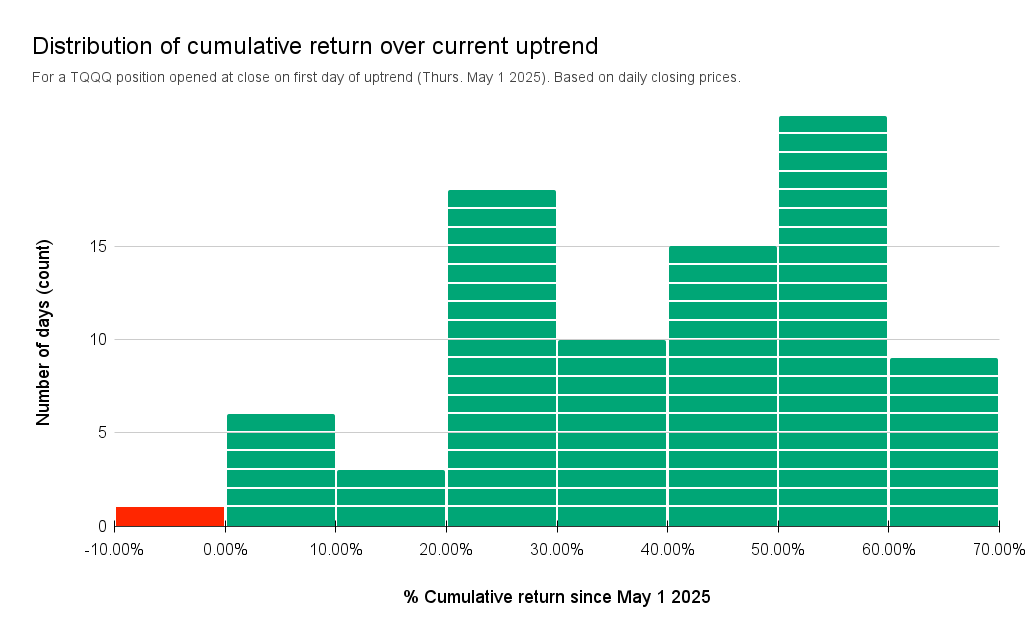

Market Signal, Trend Count, closing prices, and cumulative return (%) over current uptrend

TQQQ vs QQQ Holdings

TQQQ is outperforming 97% of QQQ holdings since day 📈1 of current uptrend (Thurs. May 1st 2025), including all of the Magnificent 7.

| A | B | C | D | E | |

|---|---|---|---|---|---|

|

1

|

Market Cap | Symbol | %Chg since 📈1 | Close on 📈1 | Close |

|

2

|

365,370 M | QQQ | 18.42% | $481.68 | $570.40 |

|

3

|

25,737 M | MDB | 83.29% | $172.19 | $315.61 |

|

4

|

161,883 M | APP | 71.24% | $279.49 | $478.59 |

|

5

|

263,923 M | AMD | 68.27% | $96.65 | $162.63 |

|

6

|

26,026 M | TQQQ | 57.41% | $56.77 | $89.36 |

|

7

|

4,247,825 M | NVDA | 56.06% | $111.61 | $174.18 |

|

8

|

133,187 M | MU | 53.03% | $77.77 | $119.01 |

|

9

|

1,398,765 M | AVGO | 50.71% | $197.33 | $297.39 |

|

10

|

35,079 M | MCHP | 41.37% | $45.98 | $65.00 |

|

11

|

126,752 M | LRCX | 39.62% | $71.73 | $100.15 |

|

12

|

28,818 M | WBD | 38.08% | $8.43 | $11.64 |

|

13

|

51,770 M | IDXX | 37.28% | $471.38 | $647.09 |

|

14

|

371,770 M | PLTR | 34.86% | $116.20 | $156.71 |

|

15

|

2,574,934 M | GOOGL | 32.00% | $161.30 | $212.91 |

|

16

|

111,678 M | SNPS | 31.38% | $459.36 | $603.52 |

|

17

|

2,582,432 M | GOOG | 31.17% | $162.79 | $213.53 |

|

18

|

123,633 M | ADI | 29.72% | $193.74 | $251.31 |

|

19

|

59,209 M | NXPI | 29.15% | $181.84 | $234.85 |

|

20

|

1,855,719 M | META | 29.10% | $572.21 | $738.70 |

|

21

|

115,070 M | KLAC | 28.93% | $676.31 | $872.00 |

|

22

|

47,666 M | DDOG | 28.56% | $106.32 | $136.68 |

|

23

|

96,215 M | CEG | 28.00% | $240.62 | $307.98 |

|

24

|

184,082 M | TXN | 27.94% | $158.26 | $202.48 |

|

25

|

44,759 M | BKR | 25.45% | $36.19 | $45.40 |

|

26

|

20,281 M | ON | 25.23% | $39.60 | $49.59 |

|

27

|

104,770 M | DASH | 25.00% | $196.20 | $245.25 |

|

28

|

56,992 M | FAST | 23.06% | $40.35 | $49.66 |

|

29

|

43,135 M | ZS | 22.02% | $227.06 | $277.05 |

|

30

|

106,579 M | INTC | 21.87% | $19.98 | $24.35 |

|

31

|

2,442,265 M | AMZN | 20.40% | $190.20 | $229.00 |

|

32

|

58,666 M | AXON | 20.32% | $621.10 | $747.29 |

|

33

|

146,507 M | ARM | 19.85% | $115.40 | $138.31 |

|

34

|

3,766,311 M | MSFT | 19.11% | $425.40 | $506.69 |

|

35

|

1,076,881 M | TSLA | 19.02% | $280.52 | $333.87 |

|

36

|

273,596 M | CSCO | 18.87% | $58.12 | $69.09 |

|

37

|

173,428 M | QCOM | 18.87% | $135.21 | $160.73 |

|

38

|

43,023 M | EA | 18.50% | $145.10 | $171.95 |

|

39

|

32,907 M | ANSS | 17.07% | $319.73 | $374.30 |

|

40

|

95,489 M | CDNS | 16.92% | $299.73 | $350.43 |

|

41

|

37,912 M | CSGP | 16.86% | $76.58 | $89.49 |

|

42

|

60,608 M | CSX | 15.65% | $28.11 | $32.51 |

|

43

|

67,328 M | ADSK | 15.07% | $273.49 | $314.70 |

|

44

|

170,670 M | PDD | 13.45% | $105.97 | $120.22 |

|

45

|

247,728 M | AZN | 13.32% | $70.51 | $79.90 |

|

46

|

291,998 M | ASML | 11.38% | $666.72 | $742.62 |

|

47

|

52,500 M | PCAR | 11.36% | $89.78 | $99.98 |

|

48

|

203,513 M | PEP | 11.31% | $133.55 | $148.65 |

|

49

|

87,972 M | ORLY | 10.48% | $93.85 | $103.68 |

|

50

|

43,064 M | FANG | 10.33% | $134.83 | $148.76 |

|

51

|

72,713 M | MAR | 9.80% | $243.95 | $267.86 |

|

52

|

181,465 M | BKNG | 9.75% | $5,101.43 | $5,599.05 |

|

53

|

140,174 M | GILD | 9.41% | $103.25 | $112.97 |

|

54

|

19,385 M | BIIB | 9.34% | $120.93 | $132.22 |

|

55

|

33,662 M | GEHC | 8.96% | $67.67 | $73.73 |

|

56

|

3,445,048 M | AAPL | 8.82% | $213.32 | $232.14 |

|

57

|

128,068 M | AMAT | 7.92% | $148.96 | $160.76 |

|

58

|

125,370 M | MELI | 7.77% | $2,294.52 | $2,472.91 |

|

59

|

100,246 M | SBUX | 7.54% | $82.01 | $88.19 |

|

60

|

67,058 M | PYPL | 7.31% | $65.41 | $70.19 |

|

61

|

29,545 M | DXCM | 7.23% | $70.26 | $75.34 |

|

62

|

186,058 M | INTU | 7.03% | $623.19 | $667.00 |

|

63

|

224,275 M | LIN | 6.75% | $448.05 | $478.29 |

|

64

|

513,417 M | NFLX | 6.60% | $1,133.47 | $1,208.25 |

|

65

|

48,132 M | ROST | 5.92% | $138.93 | $147.16 |

|

66

|

79,915 M | ABNB | 5.26% | $124.01 | $130.53 |

|

67

|

60,939 M | MNST | 4.86% | $59.52 | $62.41 |

|

68

|

139,360 M | HON | 4.16% | $210.74 | $219.50 |

|

69

|

59,373 M | AEP | 3.24% | $107.54 | $111.02 |

|

70

|

54,202 M | MRVL | 3.14% | $60.95 | $62.87 |

|

71

|

26,726 M | TTD | 3.02% | $53.06 | $54.66 |

|

72

|

42,813 M | XEL | 2.83% | $70.40 | $72.39 |

|

73

|

127,255 M | PANW | 2.28% | $186.27 | $190.52 |

|

74

|

283,594 M | TMUS | 2.02% | $247.00 | $251.99 |

|

75

|

123,153 M | ADP | 1.79% | $298.69 | $304.05 |

|

76

|

21,594 M | CDW | 1.45% | $162.40 | $164.76 |

|

77

|

154,892 M | AMGN | 1.38% | $283.78 | $287.71 |

|

78

|

125,424 M | CMCSA | 0.44% | $33.82 | $33.97 |

|

79

|

31,729 M | ODFL | 0.27% | $150.56 | $150.97 |

|

80

|

84,637 M | CTAS | 0.23% | $209.55 | $210.03 |

|

81

|

40,409 M | CCEP | -0.76% | $89.54 | $88.86 |

|

82

|

43,031 M | TTWO | -0.81% | $235.17 | $233.27 |

|

83

|

61,547 M | REGN | -1.58% | $590.00 | $580.70 |

|

84

|

33,105 M | KHC | -1.86% | $28.50 | $27.97 |

|

85

|

106,330 M | CRWD | -1.89% | $431.88 | $423.70 |

|

86

|

35,287 M | CTSH | -3.96% | $75.23 | $72.25 |

|

87

|

151,312 M | ADBE | -4.79% | $374.63 | $356.70 |

|

88

|

50,238 M | PAYX | -4.88% | $146.61 | $139.46 |

|

89

|

18,531 M | GFS | -5.09% | $35.18 | $33.39 |

|

90

|

418,341 M | COST | -5.58% | $999.04 | $943.32 |

|

91

|

56,638 M | ROP | -5.61% | $557.59 | $526.31 |

|

92

|

44,116 M | EXC | -6.27% | $46.60 | $43.68 |

|

93

|

61,629 M | WDAY | -6.40% | $246.61 | $230.82 |

|

94

|

169,665 M | ISRG | -8.49% | $517.18 | $473.30 |

|

95

|

37,460 M | VRSK | -8.96% | $294.51 | $268.12 |

|

96

|

79,500 M | MDLZ | -9.47% | $67.87 | $61.44 |

|

97

|

94,823 M | MSTR | -12.37% | $381.60 | $334.41 |

|

98

|

39,517 M | KDP | -14.54% | $34.04 | $29.09 |

|

99

|

47,196 M | CPRT | -19.32% | $60.50 | $48.81 |

|

100

|

100,254 M | VRTX | -21.62% | $498.86 | $391.02 |

|

101

|

46,638 M | TEAM | -22.39% | $229.07 | $177.78 |

|

102

|

60,359 M | FTNT | -24.41% | $104.21 | $78.77 |

|

103

|

24,233 M | LULU | -24.72% | $268.60 | $202.20 |

|

104

|

36,276 M | CHTR | -30.66% | $383.00 | $265.58 |

Assuming 3% for the risk-free rate, the Sharpe Ratio for this investment is 3.36.

This position has seen only one day in the red, and has been up +50% or more for 36.90% of the current uptrend.

In other words, an investor holding this position over the current 84 day uptrend had 31 days to exit for a return of +50% or more.