Aug. 15th 2025

TQQQ outperforming 99% of QQQ holdings

Market Signal: +7 STRONG BULLISH

The Market Signal remains in STRONG BULLISH range. However, for the first time throughout the current uptrend, zero NASDAQ-100 holdings closed at a 52-week high today - a cautionary sign of weakness.

NASDAQ-100 52-week highs

Zero NASDAQ-100 (QQQ) holdings closed at a 52-week high today.

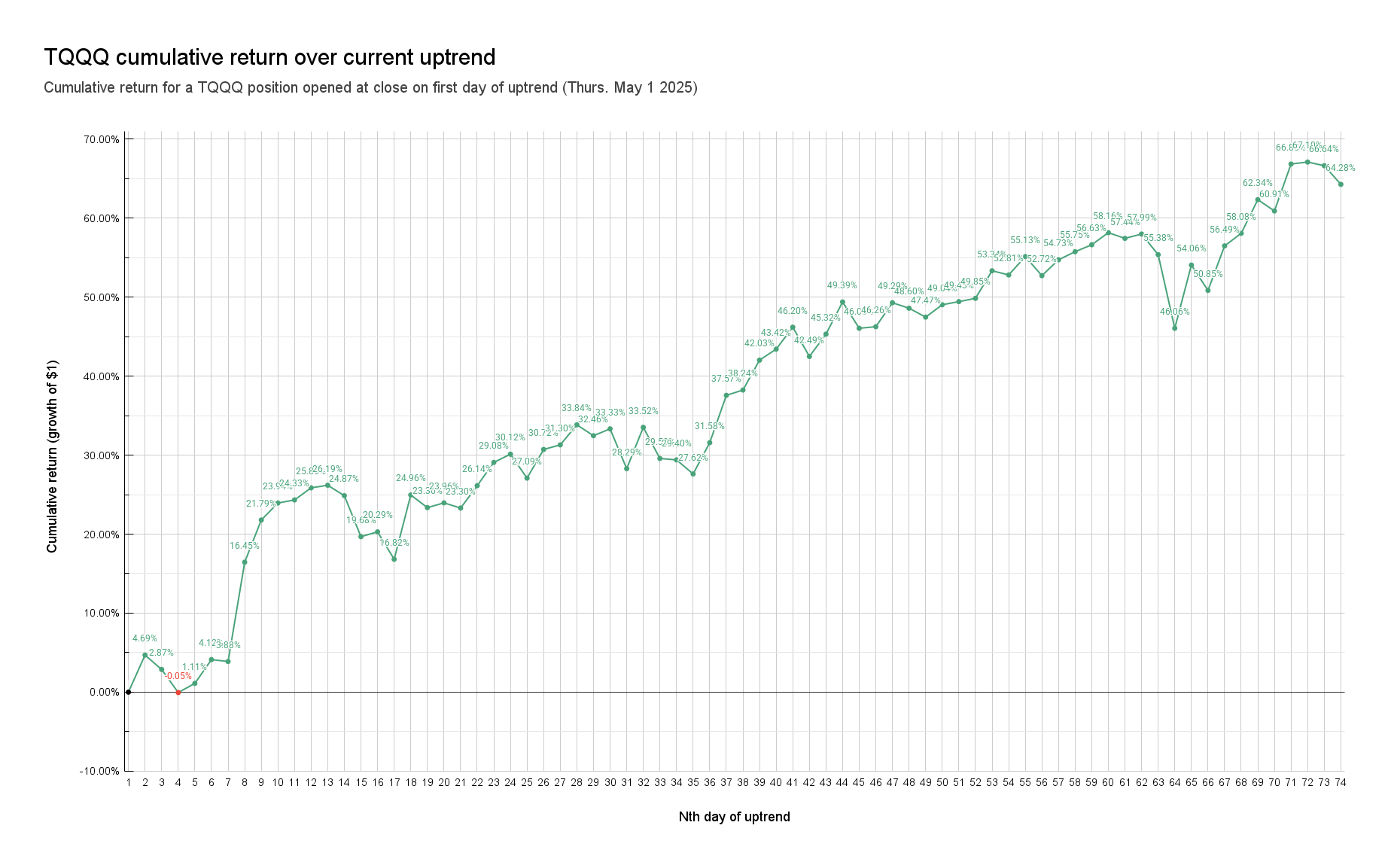

📈74th day of uptrend

Day 📈1 of current uptrend occurred on Thurs. May 1st 2025.

QQQ+19.86% since start of current uptrendTQQQ+64.28% since start of current uptrend

| A | B | C | D | E | F | G | |

|---|---|---|---|---|---|---|---|

|

1

|

Market Signal | Trend Count | QQQ Close | QQQ %chg since 📈1 | TQQQ close | TQQQ %chg since 📈1 | Date |

|

2

|

2 | 📈1 | $481.68 | 0.00% | $56.77 | 0.00% | Thu 5/1/25 |

|

3

|

2 | 📈2 | $488.83 | 1.48% | $59.43 | 4.69% | Fri 5/2/25 |

|

4

|

2 | 📈3 | $485.93 | 0.88% | $58.40 | 2.87% | Mon 5/5/25 |

|

5

|

2 | 📈4 | $481.41 | -0.06% | $56.74 | -0.05% | Tue 5/6/25 |

|

6

|

2 | 📈5 | $483.30 | 0.34% | $57.40 | 1.11% | Wed 5/7/25 |

|

7

|

2 | 📈6 | $488.29 | 1.37% | $59.11 | 4.12% | Thu 5/8/25 |

|

8

|

2 | 📈7 | $487.97 | 1.31% | $58.97 | 3.88% | Fri 5/9/25 |

|

9

|

3 | 📈8 | $507.85 | 5.43% | $66.11 | 16.45% | Mon 5/12/25 |

|

10

|

3 | 📈9 | $515.59 | 7.04% | $69.14 | 21.79% | Tue 5/13/25 |

|

11

|

3 | 📈10 | $518.68 | 7.68% | $70.36 | 23.94% | Wed 5/14/25 |

|

12

|

3 | 📈11 | $519.25 | 7.80% | $70.58 | 24.33% | Thu 5/15/25 |

|

13

|

3 | 📈12 | $521.51 | 8.27% | $71.45 | 25.86% | Fri 5/16/25 |

|

14

|

3 | 📈13 | $522.01 | 8.37% | $71.64 | 26.19% | Mon 5/19/25 |

|

15

|

3 | 📈14 | $520.27 | 8.01% | $70.89 | 24.87% | Tue 5/20/25 |

|

16

|

3 | 📈15 | $513.04 | 6.51% | $67.94 | 19.68% | Wed 5/21/25 |

|

17

|

2 | 📈16 | $514.00 | 6.71% | $68.29 | 20.29% | Thu 5/22/25 |

|

18

|

2 | 📈17 | $509.24 | 5.72% | $66.32 | 16.82% | Fri 5/23/25 |

|

19

|

4 | 📈18 | $521.22 | 8.21% | $70.94 | 24.96% | Tue 5/27/25 |

|

20

|

3 | 📈19 | $518.91 | 7.73% | $70.03 | 23.36% | Wed 5/28/25 |

|

21

|

3 | 📈20 | $519.93 | 7.94% | $70.37 | 23.96% | Thu 5/29/25 |

|

22

|

3 | 📈21 | $519.11 | 7.77% | $70.00 | 23.30% | Fri 5/30/25 |

|

23

|

4 | 📈22 | $523.21 | 8.62% | $71.61 | 26.14% | Mon 6/2/25 |

|

24

|

4 | 📈23 | $527.30 | 9.47% | $73.28 | 29.08% | Tue 6/3/25 |

|

25

|

3 | 📈24 | $528.77 | 9.78% | $73.87 | 30.12% | Wed 6/4/25 |

|

26

|

3 | 📈25 | $524.79 | 8.95% | $72.15 | 27.09% | Thu 6/5/25 |

|

27

|

4 | 📈26 | $529.92 | 10.01% | $74.21 | 30.72% | Fri 6/6/25 |

|

28

|

3 | 📈27 | $530.70 | 10.18% | $74.54 | 31.30% | Mon 6/9/25 |

|

29

|

3 | 📈28 | $534.21 | 10.91% | $75.98 | 33.84% | Tue 6/10/25 |

|

30

|

3 | 📈29 | $532.41 | 10.53% | $75.20 | 32.46% | Wed 6/11/25 |

|

31

|

3 | 📈30 | $533.66 | 10.79% | $75.69 | 33.33% | Thu 6/12/25 |

|

32

|

2 | 📈31 | $526.96 | 9.40% | $72.83 | 28.29% | Fri 6/13/25 |

|

33

|

3 | 📈32 | $534.29 | 10.92% | $75.80 | 33.52% | Mon 6/16/25 |

|

34

|

2 | 📈33 | $529.08 | 9.84% | $73.56 | 29.58% | Tue 6/17/25 |

|

35

|

2 | 📈34 | $528.99 | 9.82% | $73.46 | 29.40% | Wed 6/18/25 |

|

36

|

2 | 📈35 | $526.83 | 9.37% | $72.45 | 27.62% | Fri 6/20/25 |

|

37

|

7 | 📈36 | $531.65 | 10.37% | $74.70 | 31.58% | Mon 6/23/25 |

|

38

|

7 | 📈37 | $539.78 | 12.06% | $78.10 | 37.57% | Tue 6/24/25 |

|

39

|

7 | 📈38 | $541.16 | 12.35% | $78.48 | 38.24% | Wed 6/25/25 |

|

40

|

8 | 📈39 | $546.22 | 13.40% | $80.63 | 42.03% | Thu 6/26/25 |

|

41

|

7 | 📈40 | $548.09 | 13.79% | $81.42 | 43.42% | Fri 6/27/25 |

|

42

|

8 | 📈41 | $551.64 | 14.52% | $83.00 | 46.20% | Mon 6/30/25 |

|

43

|

7 | 📈42 | $546.99 | 13.56% | $80.89 | 42.49% | Tue 7/1/25 |

|

44

|

7 | 📈43 | $550.80 | 14.35% | $82.50 | 45.32% | Wed 7/2/25 |

|

45

|

8 | 📈44 | $556.22 | 15.48% | $84.81 | 49.39% | Thu 7/3/25 |

|

46

|

7 | 📈45 | $552.03 | 14.61% | $82.92 | 46.06% | Mon 7/7/25 |

|

47

|

7 | 📈46 | $552.34 | 14.67% | $83.03 | 46.26% | Tue 7/8/25 |

|

48

|

7 | 📈47 | $556.25 | 15.48% | $84.75 | 49.29% | Wed 7/9/25 |

|

49

|

7 | 📈48 | $555.45 | 15.32% | $84.36 | 48.60% | Thu 7/10/25 |

|

50

|

7 | 📈49 | $554.20 | 15.06% | $83.72 | 47.47% | Fri 7/11/25 |

|

51

|

7 | 📈50 | $556.21 | 15.47% | $84.61 | 49.04% | Mon 7/14/25 |

|

52

|

7 | 📈51 | $556.72 | 15.58% | $84.83 | 49.43% | Tue 7/15/25 |

|

53

|

7 | 📈52 | $557.29 | 15.70% | $85.07 | 49.85% | Wed 7/16/25 |

|

54

|

7 | 📈53 | $561.80 | 16.63% | $87.05 | 53.34% | Thu 7/17/25 |

|

55

|

7 | 📈54 | $561.26 | 16.52% | $86.75 | 52.81% | Fri 7/18/25 |

|

56

|

7 | 📈55 | $564.17 | 17.13% | $88.07 | 55.13% | Mon 7/21/25 |

|

57

|

7 | 📈56 | $561.25 | 16.52% | $86.70 | 52.72% | Tue 7/22/25 |

|

58

|

7 | 📈57 | $563.81 | 17.05% | $87.84 | 54.73% | Wed 7/23/25 |

|

59

|

7 | 📈58 | $565.01 | 17.30% | $88.42 | 55.75% | Thu 7/24/25 |

|

60

|

7 | 📈59 | $566.37 | 17.58% | $88.92 | 56.63% | Fri 7/25/25 |

|

61

|

7 | 📈60 | $568.14 | 17.95% | $89.79 | 58.16% | Mon 7/28/25 |

|

62

|

7 | 📈61 | $567.26 | 17.77% | $89.38 | 57.44% | Tue 7/29/25 |

|

63

|

7 | 📈62 | $568.02 | 17.92% | $89.69 | 57.99% | Wed 7/30/25 |

|

64

|

6 | 📈63 | $565.01 | 17.30% | $88.21 | 55.38% | Thu 7/31/25 |

|

65

|

5 | 📈64 | $553.88 | 14.99% | $82.92 | 46.06% | Fri 8/1/25 |

|

66

|

7 | 📈65 | $564.10 | 17.11% | $87.46 | 54.06% | Mon 8/4/25 |

|

67

|

6 | 📈66 | $560.27 | 16.32% | $85.64 | 50.85% | Tue 8/5/25 |

|

68

|

7 | 📈67 | $567.32 | 17.78% | $88.84 | 56.49% | Wed 8/6/25 |

|

69

|

7 | 📈68 | $569.24 | 18.18% | $89.74 | 58.08% | Thu 8/7/25 |

|

70

|

7 | 📈69 | $574.55 | 19.28% | $92.16 | 62.34% | Fri 8/8/25 |

|

71

|

7 | 📈70 | $572.85 | 18.93% | $91.35 | 60.91% | Mon 8/11/25 |

|

72

|

7 | 📈71 | $580.05 | 20.42% | $94.72 | 66.85% | Tue 8/12/25 |

|

73

|

7 | 📈72 | $580.34 | 20.48% | $94.86 | 67.10% | Wed 8/13/25 |

|

74

|

7 | 📈73 | $579.89 | 20.39% | $94.60 | 66.64% | Thu 8/14/25 |

|

75

|

7 | 📈74 | $577.34 | 19.86% | $93.26 | 64.28% | Fri 8/15/25 |

Market Signal, Trend Count, closing prices, and cumulative return (%) over current uptrend

TQQQ vs QQQ Holdings

TQQQ is outperforming 99% of QQQ holdings since day 📈1 of current uptrend (Thurs. May 1st 2025).

TQQQ has outperformed every NASDAQ-100 holding besides AMD from Thurs. May 1st 2025 to today.

In other words, there is just a 1% chance of having picked NASDAQ-100 (QQQ) stock that outperformed TQQQ during the current uptrend.

| A | B | C | D | E | |

|---|---|---|---|---|---|

|

1

|

Market Cap | Symbol | %Chg since 📈1 | Close on 📈1 | Close |

|

2

|

368,954 M | QQQ | 19.86% | $481.68 | $577.34 |

|

3

|

284,501 M | AMD | 83.66% | $96.65 | $177.51 |

|

4

|

26,712 M | TQQQ | 64.28% | $56.77 | $93.26 |

|

5

|

4,423,900 M | NVDA | 61.68% | $111.61 | $180.45 |

|

6

|

148,444 M | APP | 56.96% | $279.49 | $438.68 |

|

7

|

137,328 M | MU | 55.42% | $77.77 | $120.87 |

|

8

|

1,427,974 M | AVGO | 55.24% | $197.33 | $306.34 |

|

9

|

409,490 M | PLTR | 52.47% | $116.20 | $177.17 |

|

10

|

35,503 M | MCHP | 42.91% | $45.98 | $65.71 |

|

11

|

29,290 M | WBD | 40.57% | $8.43 | $11.85 |

|

12

|

125,043 M | LRCX | 38.73% | $71.73 | $99.51 |

|

13

|

51,496 M | IDXX | 38.07% | $471.38 | $650.84 |

|

14

|

1,923,346 M | META | 37.23% | $572.21 | $785.23 |

|

15

|

115,216 M | SNPS | 34.52% | $459.36 | $617.91 |

|

16

|

100,588 M | CEG | 33.92% | $240.62 | $322.23 |

|

17

|

116,444 M | KLAC | 29.37% | $676.31 | $874.94 |

|

18

|

67,058 M | CSX | 29.21% | $28.11 | $36.32 |

|

19

|

20,823 M | ON | 29.02% | $39.60 | $51.09 |

|

20

|

18,784 M | MDB | 26.76% | $172.19 | $218.26 |

|

21

|

2,455,142 M | GOOGL | 26.41% | $161.30 | $203.90 |

|

22

|

107,512 M | DASH | 26.40% | $196.20 | $248.00 |

|

23

|

2,465,725 M | GOOG | 25.87% | $162.79 | $204.91 |

|

24

|

58,557 M | NXPI | 25.81% | $181.84 | $228.78 |

|

25

|

65,510 M | MRVL | 25.00% | $60.95 | $76.19 |

|

26

|

176,664 M | TXN | 22.94% | $158.26 | $194.57 |

|

27

|

103,188 M | INTC | 22.92% | $19.98 | $24.56 |

|

28

|

3,837,149 M | MSFT | 22.28% | $425.40 | $520.17 |

|

29

|

2,460,395 M | AMZN | 21.47% | $190.20 | $231.03 |

|

30

|

61,599 M | AXON | 21.44% | $621.10 | $754.24 |

|

31

|

56,303 M | FAST | 21.14% | $40.35 | $48.88 |

|

32

|

42,937 M | ZS | 21.10% | $227.06 | $274.97 |

|

33

|

42,157 M | EA | 20.38% | $145.10 | $174.67 |

|

34

|

148,895 M | ARM | 20.37% | $115.40 | $138.91 |

|

35

|

44,911 M | DDOG | 19.69% | $106.32 | $127.25 |

|

36

|

115,006 M | ADI | 19.56% | $193.74 | $231.63 |

|

37

|

42,610 M | BKR | 18.26% | $36.19 | $42.80 |

|

38

|

1,079,138 M | TSLA | 17.84% | $280.52 | $330.56 |

|

39

|

37,627 M | CSGP | 17.08% | $76.58 | $89.66 |

|

40

|

172,111 M | QCOM | 16.74% | $135.21 | $157.85 |

|

41

|

96,001 M | CDNS | 16.73% | $299.73 | $349.88 |

|

42

|

31,780 M | DXCM | 15.21% | $70.26 | $80.95 |

|

43

|

200,619 M | INTU | 15.01% | $623.19 | $716.74 |

|

44

|

147,209 M | GILD | 14.64% | $103.25 | $118.37 |

|

45

|

20,199 M | BIIB | 14.61% | $120.93 | $138.60 |

|

46

|

263,716 M | CSCO | 13.90% | $58.12 | $66.20 |

|

47

|

204,951 M | PEP | 12.62% | $133.55 | $150.40 |

|

48

|

246,333 M | AZN | 12.28% | $70.51 | $79.17 |

|

49

|

169,286 M | PDD | 12.25% | $105.97 | $118.95 |

|

50

|

293,186 M | ASML | 11.32% | $666.72 | $742.16 |

|

51

|

105,429 M | SBUX | 10.47% | $82.01 | $90.60 |

|

52

|

51,660 M | PCAR | 9.40% | $89.78 | $98.22 |

|

53

|

526,208 M | NFLX | 9.31% | $1,133.47 | $1,238.95 |

|

54

|

72,316 M | MAR | 8.71% | $243.95 | $265.20 |

|

55

|

62,677 M | MNST | 8.60% | $59.52 | $64.64 |

|

56

|

131,778 M | AMAT | 8.59% | $148.96 | $161.76 |

|

57

|

3,427,240 M | AAPL | 8.56% | $213.32 | $231.59 |

|

58

|

33,585 M | GEHC | 8.47% | $67.67 | $73.40 |

|

59

|

86,033 M | ORLY | 8.19% | $93.85 | $101.54 |

|

60

|

224,807 M | LIN | 7.15% | $448.05 | $480.08 |

|

61

|

177,813 M | BKNG | 6.92% | $5,101.43 | $5,454.29 |

|

62

|

66,633 M | PYPL | 5.84% | $65.41 | $69.23 |

|

63

|

47,769 M | ROST | 5.77% | $138.93 | $146.94 |

|

64

|

61,806 M | ADSK | 4.84% | $273.49 | $286.73 |

|

65

|

159,231 M | AMGN | 4.47% | $283.78 | $296.47 |

|

66

|

120,349 M | MELI | 4.26% | $2,294.52 | $2,392.30 |

|

67

|

59,555 M | AEP | 4.14% | $107.54 | $111.99 |

|

68

|

40,499 M | FANG | 4.00% | $134.83 | $140.22 |

|

69

|

86,465 M | CTAS | 3.34% | $209.55 | $216.55 |

|

70

|

287,646 M | TMUS | 3.09% | $247.00 | $254.63 |

|

71

|

137,341 M | HON | 2.86% | $210.74 | $216.77 |

|

72

|

47,321 M | KDP | 2.17% | $34.04 | $34.78 |

|

73

|

42,719 M | XEL | 2.17% | $70.40 | $71.93 |

|

74

|

41,000 M | CCEP | 1.30% | $89.54 | $90.70 |

|

75

|

122,327 M | ADP | 1.04% | $298.69 | $301.79 |

|

76

|

76,753 M | ABNB | 0.88% | $124.01 | $125.10 |

|

77

|

21,780 M | CDW | 0.84% | $162.40 | $163.76 |

|

78

|

31,842 M | ODFL | 0.39% | $150.56 | $151.14 |

|

79

|

105,645 M | CRWD | -0.92% | $431.88 | $427.90 |

|

80

|

123,744 M | CMCSA | -1.09% | $33.82 | $33.45 |

|

81

|

42,922 M | TTWO | -1.27% | $235.17 | $232.18 |

|

82

|

61,260 M | REGN | -1.63% | $590.00 | $580.41 |

|

83

|

26,792 M | TTD | -1.77% | $53.06 | $52.12 |

|

84

|

433,432 M | COST | -2.70% | $999.04 | $972.04 |

|

85

|

32,318 M | KHC | -2.91% | $28.50 | $27.67 |

|

86

|

104,064 M | MSTR | -4.00% | $381.60 | $366.32 |

|

87

|

44,707 M | EXC | -4.33% | $46.60 | $44.58 |

|

88

|

117,450 M | PANW | -4.93% | $186.27 | $177.09 |

|

89

|

57,277 M | ROP | -5.01% | $557.59 | $529.64 |

|

90

|

151,647 M | ADBE | -5.28% | $374.63 | $354.85 |

|

91

|

49,761 M | PAYX | -5.70% | $146.61 | $138.25 |

|

92

|

18,564 M | GFS | -6.00% | $35.18 | $33.07 |

|

93

|

34,282 M | CTSH | -6.95% | $75.23 | $70.00 |

|

94

|

173,393 M | ISRG | -7.14% | $517.18 | $480.26 |

|

95

|

61,361 M | WDAY | -8.32% | $246.61 | $226.09 |

|

96

|

80,580 M | MDLZ | -8.53% | $67.87 | $62.08 |

|

97

|

37,031 M | VRSK | -9.05% | $294.51 | $267.86 |

|

98

|

100,626 M | VRTX | -21.26% | $498.86 | $392.79 |

|

99

|

45,789 M | CPRT | -22.18% | $60.50 | $47.08 |

|

100

|

61,585 M | FTNT | -24.09% | $104.21 | $79.11 |

|

101

|

24,688 M | LULU | -26.11% | $268.60 | $198.46 |

|

102

|

44,275 M | TEAM | -27.10% | $229.07 | $167.00 |

|

103

|

36,432 M | CHTR | -30.08% | $383.00 | $267.80 |

|

104

|

32,907 M | ANSS | -100.00% | $319.73 | $0.00 |

Assuming 3% for the risk-free rate, the Sharpe Ratio for this investment is 4.15.