Aug. 1st 2025

QQQ takes a hit on weak jobs data; TQQQ still outperforming during uptrend

Market Signal: +4 MODERATE BULLISH

NASDAQ-100 52-week highs

The following NASDAQ-100 (QQQ) holdings closed at a 52-week high today:

AEP $113.58 +0.39%XEL $73.47 +0.04%

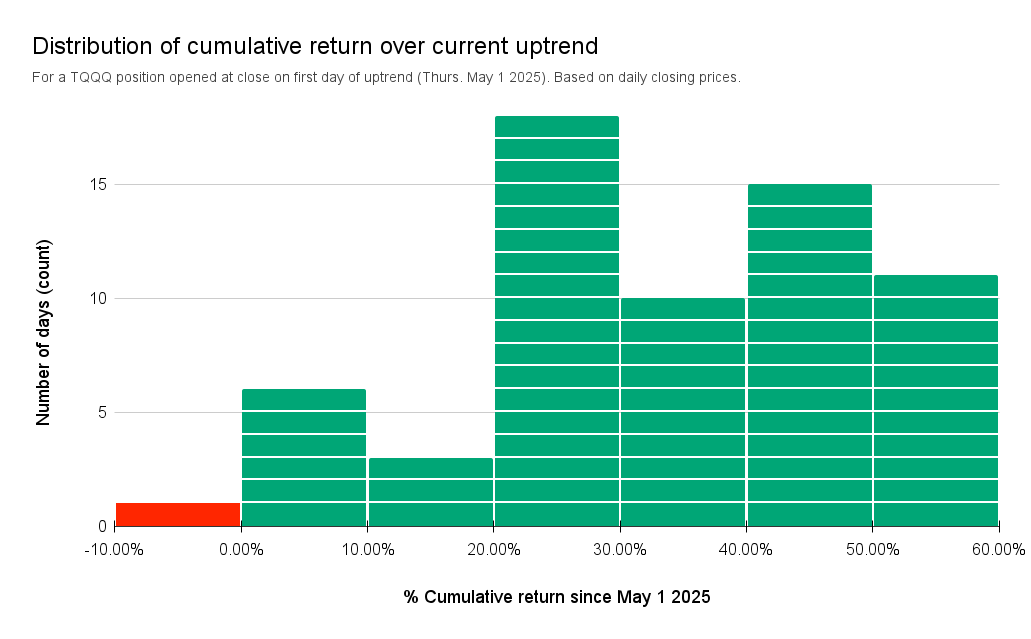

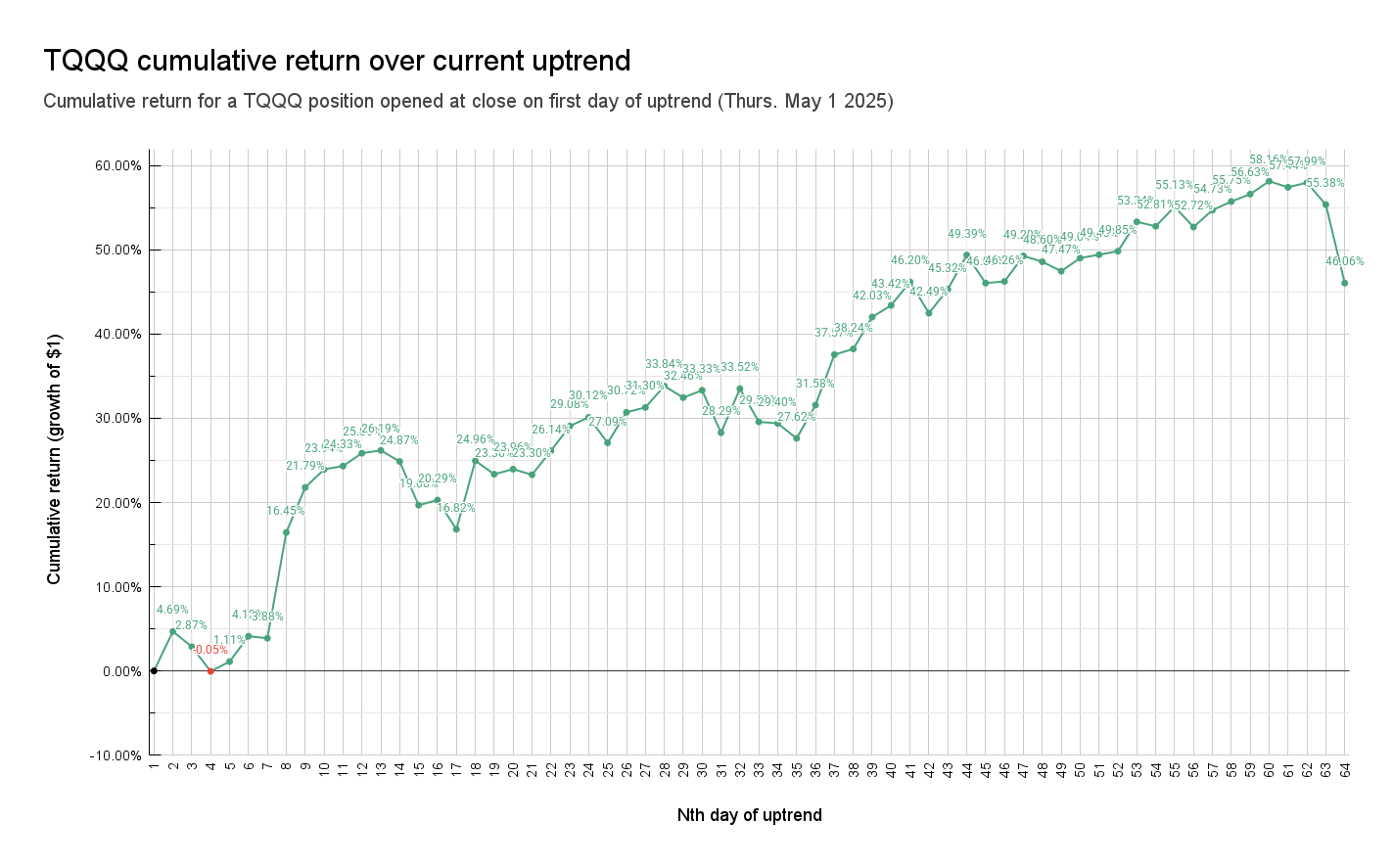

📈64th day of uptrend

Day 📈1 of current uptrend occurred on Thurs. May 1st 2025.

QQQ+14.99% since start of current uptrendTQQQ+46.06% since start of current uptrend

| A | B | C | D | E | F | G | |

|---|---|---|---|---|---|---|---|

|

1

|

Market Signal | Trend Count | QQQ Close | QQQ %chg since 📈1 | TQQQ close | TQQQ %chg since 📈1 | Date |

|

2

|

2 | 📈1 | $481.68 | 0.00% | $56.77 | 0.00% | Thu 5/1/25 |

|

3

|

2 | 📈2 | $488.83 | 1.48% | $59.43 | 4.69% | Fri 5/2/25 |

|

4

|

2 | 📈3 | $485.93 | 0.88% | $58.40 | 2.87% | Mon 5/5/25 |

|

5

|

2 | 📈4 | $481.41 | -0.06% | $56.74 | -0.05% | Tue 5/6/25 |

|

6

|

2 | 📈5 | $483.30 | 0.34% | $57.40 | 1.11% | Wed 5/7/25 |

|

7

|

2 | 📈6 | $488.29 | 1.37% | $59.11 | 4.12% | Thu 5/8/25 |

|

8

|

2 | 📈7 | $487.97 | 1.31% | $58.97 | 3.88% | Fri 5/9/25 |

|

9

|

3 | 📈8 | $507.85 | 5.43% | $66.11 | 16.45% | Mon 5/12/25 |

|

10

|

3 | 📈9 | $515.59 | 7.04% | $69.14 | 21.79% | Tue 5/13/25 |

|

11

|

3 | 📈10 | $518.68 | 7.68% | $70.36 | 23.94% | Wed 5/14/25 |

|

12

|

3 | 📈11 | $519.25 | 7.80% | $70.58 | 24.33% | Thu 5/15/25 |

|

13

|

3 | 📈12 | $521.51 | 8.27% | $71.45 | 25.86% | Fri 5/16/25 |

|

14

|

3 | 📈13 | $522.01 | 8.37% | $71.64 | 26.19% | Mon 5/19/25 |

|

15

|

3 | 📈14 | $520.27 | 8.01% | $70.89 | 24.87% | Tue 5/20/25 |

|

16

|

3 | 📈15 | $513.04 | 6.51% | $67.94 | 19.68% | Wed 5/21/25 |

|

17

|

2 | 📈16 | $514.00 | 6.71% | $68.29 | 20.29% | Thu 5/22/25 |

|

18

|

2 | 📈17 | $509.24 | 5.72% | $66.32 | 16.82% | Fri 5/23/25 |

|

19

|

4 | 📈18 | $521.22 | 8.21% | $70.94 | 24.96% | Tue 5/27/25 |

|

20

|

3 | 📈19 | $518.91 | 7.73% | $70.03 | 23.36% | Wed 5/28/25 |

|

21

|

3 | 📈20 | $519.93 | 7.94% | $70.37 | 23.96% | Thu 5/29/25 |

|

22

|

3 | 📈21 | $519.11 | 7.77% | $70.00 | 23.30% | Fri 5/30/25 |

|

23

|

4 | 📈22 | $523.21 | 8.62% | $71.61 | 26.14% | Mon 6/2/25 |

|

24

|

4 | 📈23 | $527.30 | 9.47% | $73.28 | 29.08% | Tue 6/3/25 |

|

25

|

3 | 📈24 | $528.77 | 9.78% | $73.87 | 30.12% | Wed 6/4/25 |

|

26

|

3 | 📈25 | $524.79 | 8.95% | $72.15 | 27.09% | Thu 6/5/25 |

|

27

|

4 | 📈26 | $529.92 | 10.01% | $74.21 | 30.72% | Fri 6/6/25 |

|

28

|

3 | 📈27 | $530.70 | 10.18% | $74.54 | 31.30% | Mon 6/9/25 |

|

29

|

3 | 📈28 | $534.21 | 10.91% | $75.98 | 33.84% | Tue 6/10/25 |

|

30

|

3 | 📈29 | $532.41 | 10.53% | $75.20 | 32.46% | Wed 6/11/25 |

|

31

|

3 | 📈30 | $533.66 | 10.79% | $75.69 | 33.33% | Thu 6/12/25 |

|

32

|

2 | 📈31 | $526.96 | 9.40% | $72.83 | 28.29% | Fri 6/13/25 |

|

33

|

3 | 📈32 | $534.29 | 10.92% | $75.80 | 33.52% | Mon 6/16/25 |

|

34

|

2 | 📈33 | $529.08 | 9.84% | $73.56 | 29.58% | Tue 6/17/25 |

|

35

|

2 | 📈34 | $528.99 | 9.82% | $73.46 | 29.40% | Wed 6/18/25 |

|

36

|

2 | 📈35 | $526.83 | 9.37% | $72.45 | 27.62% | Fri 6/20/25 |

|

37

|

7 | 📈36 | $531.65 | 10.37% | $74.70 | 31.58% | Mon 6/23/25 |

|

38

|

7 | 📈37 | $539.78 | 12.06% | $78.10 | 37.57% | Tue 6/24/25 |

|

39

|

7 | 📈38 | $541.16 | 12.35% | $78.48 | 38.24% | Wed 6/25/25 |

|

40

|

8 | 📈39 | $546.22 | 13.40% | $80.63 | 42.03% | Thu 6/26/25 |

|

41

|

7 | 📈40 | $548.09 | 13.79% | $81.42 | 43.42% | Fri 6/27/25 |

|

42

|

8 | 📈41 | $551.64 | 14.52% | $83.00 | 46.20% | Mon 6/30/25 |

|

43

|

7 | 📈42 | $546.99 | 13.56% | $80.89 | 42.49% | Tue 7/1/25 |

|

44

|

7 | 📈43 | $550.80 | 14.35% | $82.50 | 45.32% | Wed 7/2/25 |

|

45

|

8 | 📈44 | $556.22 | 15.48% | $84.81 | 49.39% | Thu 7/3/25 |

|

46

|

7 | 📈45 | $552.03 | 14.61% | $82.92 | 46.06% | Mon 7/7/25 |

|

47

|

7 | 📈46 | $552.34 | 14.67% | $83.03 | 46.26% | Tue 7/8/25 |

|

48

|

7 | 📈47 | $556.25 | 15.48% | $84.75 | 49.29% | Wed 7/9/25 |

|

49

|

7 | 📈48 | $555.45 | 15.32% | $84.36 | 48.60% | Thu 7/10/25 |

|

50

|

7 | 📈49 | $554.20 | 15.06% | $83.72 | 47.47% | Fri 7/11/25 |

|

51

|

7 | 📈50 | $556.21 | 15.47% | $84.61 | 49.04% | Mon 7/14/25 |

|

52

|

7 | 📈51 | $556.72 | 15.58% | $84.83 | 49.43% | Tue 7/15/25 |

|

53

|

7 | 📈52 | $557.29 | 15.70% | $85.07 | 49.85% | Wed 7/16/25 |

|

54

|

7 | 📈53 | $561.80 | 16.63% | $87.05 | 53.34% | Thu 7/17/25 |

|

55

|

7 | 📈54 | $561.26 | 16.52% | $86.75 | 52.81% | Fri 7/18/25 |

|

56

|

7 | 📈55 | $564.17 | 17.13% | $88.07 | 55.13% | Mon 7/21/25 |

|

57

|

7 | 📈56 | $561.25 | 16.52% | $86.70 | 52.72% | Tue 7/22/25 |

|

58

|

7 | 📈57 | $563.81 | 17.05% | $87.84 | 54.73% | Wed 7/23/25 |

|

59

|

7 | 📈58 | $565.01 | 17.30% | $88.42 | 55.75% | Thu 7/24/25 |

|

60

|

7 | 📈59 | $566.37 | 17.58% | $88.92 | 56.63% | Fri 7/25/25 |

|

61

|

7 | 📈60 | $568.14 | 17.95% | $89.79 | 58.16% | Mon 7/28/25 |

|

62

|

7 | 📈61 | $567.26 | 17.77% | $89.38 | 57.44% | Tue 7/29/25 |

|

63

|

7 | 📈62 | $568.02 | 17.92% | $89.69 | 57.99% | Wed 7/30/25 |

|

64

|

6 | 📈63 | $565.01 | 17.30% | $88.21 | 55.38% | Thu 7/31/25 |

|

65

|

5 | 📈64 | $553.88 | 14.99% | $82.92 | 46.06% | Fri 8/1/25 |

Market Signal, Trend Count, closing prices, and cumulative return (%) over current uptrend

TQQQ vs QQQ Holdings

TQQQ is outperforming 95% of QQQ holdings since day 📈1 of current uptrend (Thurs. May 1st 2025).

| A | B | C | D | E | |

|---|---|---|---|---|---|

|

1

|

Market Cap | Symbol | %Chg since 📈1 | Close on 📈1 | Close |

|

2

|

353,763 M | QQQ | 14.99% | $481.68 | $553.88 |

|

3

|

278,395 M | AMD | 77.65% | $96.65 | $171.70 |

|

4

|

42,087 M | TTD | 62.23% | $53.06 | $86.08 |

|

5

|

4,236,606 M | NVDA | 55.65% | $111.61 | $173.72 |

|

6

|

31,841 M | WBD | 52.67% | $8.43 | $12.87 |

|

7

|

1,357,610 M | AVGO | 46.27% | $197.33 | $288.64 |

|

8

|

25,556 M | TQQQ | 46.06% | $56.77 | $82.92 |

|

9

|

35,813 M | MCHP | 44.32% | $45.98 | $66.36 |

|

10

|

23,744 M | ON | 43.48% | $39.60 | $56.82 |

|

11

|

106,803 M | CEG | 41.62% | $240.62 | $340.77 |

|

12

|

128,306 M | APP | 35.66% | $279.49 | $379.17 |

|

13

|

117,374 M | MU | 34.86% | $77.77 | $104.88 |

|

14

|

114,477 M | SNPS | 34.68% | $459.36 | $618.65 |

|

15

|

122,268 M | LRCX | 34.35% | $71.73 | $96.37 |

|

16

|

364,064 M | PLTR | 32.76% | $116.20 | $154.27 |

|

17

|

117,251 M | KLAC | 31.10% | $676.31 | $886.64 |

|

18

|

1,884,131 M | META | 31.07% | $572.21 | $750.01 |

|

19

|

18,056 M | MDB | 28.33% | $172.19 | $220.97 |

|

20

|

46,830 M | DDOG | 27.54% | $106.32 | $135.60 |

|

21

|

105,237 M | DASH | 26.58% | $196.20 | $248.35 |

|

22

|

65,268 M | CSX | 24.55% | $28.11 | $35.01 |

|

23

|

216,505 M | INTU | 24.54% | $623.19 | $776.15 |

|

24

|

40,077 M | CSGP | 23.53% | $76.58 | $94.60 |

|

25

|

43,637 M | ZS | 23.43% | $227.06 | $280.27 |

|

26

|

3,895,797 M | MSFT | 23.20% | $425.40 | $524.11 |

|

27

|

64,191 M | MRVL | 22.15% | $60.95 | $74.45 |

|

28

|

144,442 M | AMAT | 20.83% | $148.96 | $179.99 |

|

29

|

42,896 M | BKR | 20.23% | $36.19 | $43.51 |

|

30

|

57,802 M | AXON | 19.54% | $621.10 | $742.47 |

|

31

|

145,734 M | ARM | 19.22% | $115.40 | $137.58 |

|

32

|

97,271 M | CDNS | 19.10% | $299.73 | $356.97 |

|

33

|

2,287,338 M | GOOGL | 17.25% | $161.30 | $189.13 |

|

34

|

32,907 M | ANSS | 17.07% | $319.73 | $374.30 |

|

35

|

2,297,255 M | GOOG | 16.68% | $162.79 | $189.95 |

|

36

|

265,755 M | CSCO | 15.47% | $58.12 | $67.11 |

|

37

|

52,924 M | NXPI | 15.44% | $181.84 | $209.92 |

|

38

|

110,023 M | ADI | 14.44% | $193.74 | $221.71 |

|

39

|

164,427 M | TXN | 14.28% | $158.26 | $180.86 |

|

40

|

43,069 M | IDXX | 13.61% | $471.38 | $535.54 |

|

41

|

2,290,290 M | AMZN | 12.91% | $190.20 | $214.75 |

|

42

|

31,090 M | DXCM | 12.84% | $70.26 | $79.28 |

|

43

|

52,149 M | FAST | 12.60% | $40.35 | $45.44 |

|

44

|

140,788 M | GILD | 9.62% | $103.25 | $113.18 |

|

45

|

159,897 M | QCOM | 9.60% | $135.21 | $148.19 |

|

46

|

19,346 M | BIIB | 9.11% | $120.93 | $131.95 |

|

47

|

44,351 M | CCEP | 8.63% | $89.54 | $97.27 |

|

48

|

63,546 M | ADSK | 8.60% | $273.49 | $297.02 |

|

49

|

42,697 M | FANG | 8.39% | $134.83 | $146.14 |

|

50

|

39,470 M | EA | 8.26% | $145.10 | $157.08 |

|

51

|

976,118 M | TSLA | 7.88% | $280.52 | $302.63 |

|

52

|

50,662 M | PCAR | 7.46% | $89.78 | $96.48 |

|

53

|

98,734 M | SBUX | 5.91% | $82.01 | $86.86 |

|

54

|

89,260 M | CTAS | 5.70% | $209.55 | $221.50 |

|

55

|

84,139 M | ORLY | 5.62% | $93.85 | $99.12 |

|

56

|

60,742 M | AEP | 5.62% | $107.54 | $113.58 |

|

57

|

174,569 M | BKNG | 5.58% | $5,101.43 | $5,386.29 |

|

58

|

229,279 M | AZN | 4.88% | $70.51 | $73.95 |

|

59

|

69,939 M | MAR | 4.67% | $243.95 | $255.35 |

|

60

|

159,634 M | AMGN | 4.62% | $283.78 | $296.88 |

|

61

|

43,452 M | XEL | 4.36% | $70.40 | $73.47 |

|

62

|

190,685 M | PEP | 4.29% | $133.55 | $139.28 |

|

63

|

20,299 M | GFS | 3.98% | $35.18 | $36.58 |

|

64

|

22,236 M | CDW | 3.98% | $162.40 | $168.86 |

|

65

|

156,246 M | PDD | 3.86% | $105.97 | $110.06 |

|

66

|

120,453 M | MELI | 3.55% | $2,294.52 | $2,375.92 |

|

67

|

271,237 M | ASML | 3.46% | $666.72 | $689.82 |

|

68

|

111,329 M | CRWD | 3.42% | $431.88 | $446.66 |

|

69

|

138,223 M | HON | 3.31% | $210.74 | $217.71 |

|

70

|

79,016 M | ABNB | 3.23% | $124.01 | $128.02 |

|

71

|

31,891 M | GEHC | 3.22% | $67.67 | $69.85 |

|

72

|

64,115 M | PYPL | 2.60% | $65.41 | $67.11 |

|

73

|

216,256 M | LIN | 2.54% | $448.05 | $459.41 |

|

74

|

492,320 M | NFLX | 2.22% | $1,133.47 | $1,158.60 |

|

75

|

121,768 M | ADP | 0.59% | $298.69 | $300.44 |

|

76

|

57,559 M | MNST | -0.84% | $59.52 | $59.02 |

|

77

|

44,812 M | ROST | -1.38% | $138.93 | $137.01 |

|

78

|

45,263 M | KDP | -2.12% | $34.04 | $33.32 |

|

79

|

58,285 M | ROP | -2.78% | $557.59 | $542.11 |

|

80

|

84,520 M | INTC | -3.35% | $19.98 | $19.31 |

|

81

|

32,442 M | KHC | -3.82% | $28.50 | $27.41 |

|

82

|

120,071 M | CMCSA | -3.84% | $33.82 | $32.52 |

|

83

|

103,959 M | MSTR | -3.92% | $381.60 | $366.63 |

|

84

|

266,949 M | TMUS | -3.97% | $247.00 | $237.20 |

|

85

|

45,116 M | EXC | -4.14% | $46.60 | $44.67 |

|

86

|

422,421 M | COST | -4.66% | $999.04 | $952.52 |

|

87

|

50,196 M | PAYX | -4.96% | $146.61 | $139.34 |

|

88

|

3,003,398 M | AAPL | -5.13% | $213.32 | $202.38 |

|

89

|

59,233 M | REGN | -5.28% | $590.00 | $558.87 |

|

90

|

29,977 M | ODFL | -5.79% | $150.56 | $141.85 |

|

91

|

82,722 M | MDLZ | -5.81% | $67.87 | $63.93 |

|

92

|

34,476 M | CTSH | -6.17% | $75.23 | $70.59 |

|

93

|

40,690 M | TTWO | -6.20% | $235.17 | $220.58 |

|

94

|

74,521 M | FTNT | -6.57% | $104.21 | $97.36 |

|

95

|

173,187 M | ISRG | -6.59% | $517.18 | $483.12 |

|

96

|

147,537 M | ADBE | -7.16% | $374.63 | $347.80 |

|

97

|

115,473 M | PANW | -7.19% | $186.27 | $172.88 |

|

98

|

118,674 M | VRTX | -7.36% | $498.86 | $462.13 |

|

99

|

37,987 M | VRSK | -7.68% | $294.51 | $271.89 |

|

100

|

59,243 M | WDAY | -9.89% | $246.61 | $222.22 |

|

101

|

48,028 M | TEAM | -20.13% | $229.07 | $182.96 |

|

102

|

44,005 M | CPRT | -24.78% | $60.50 | $45.51 |

|

103

|

23,170 M | LULU | -28.02% | $268.60 | $193.33 |

|

104

|

36,154 M | CHTR | -30.89% | $383.00 | $264.69 |

Assuming 3% for the risk-free rate, the Sharpe Ratio for this investment is 3.64.