Apr. 4th 2025

Market falls off cliff

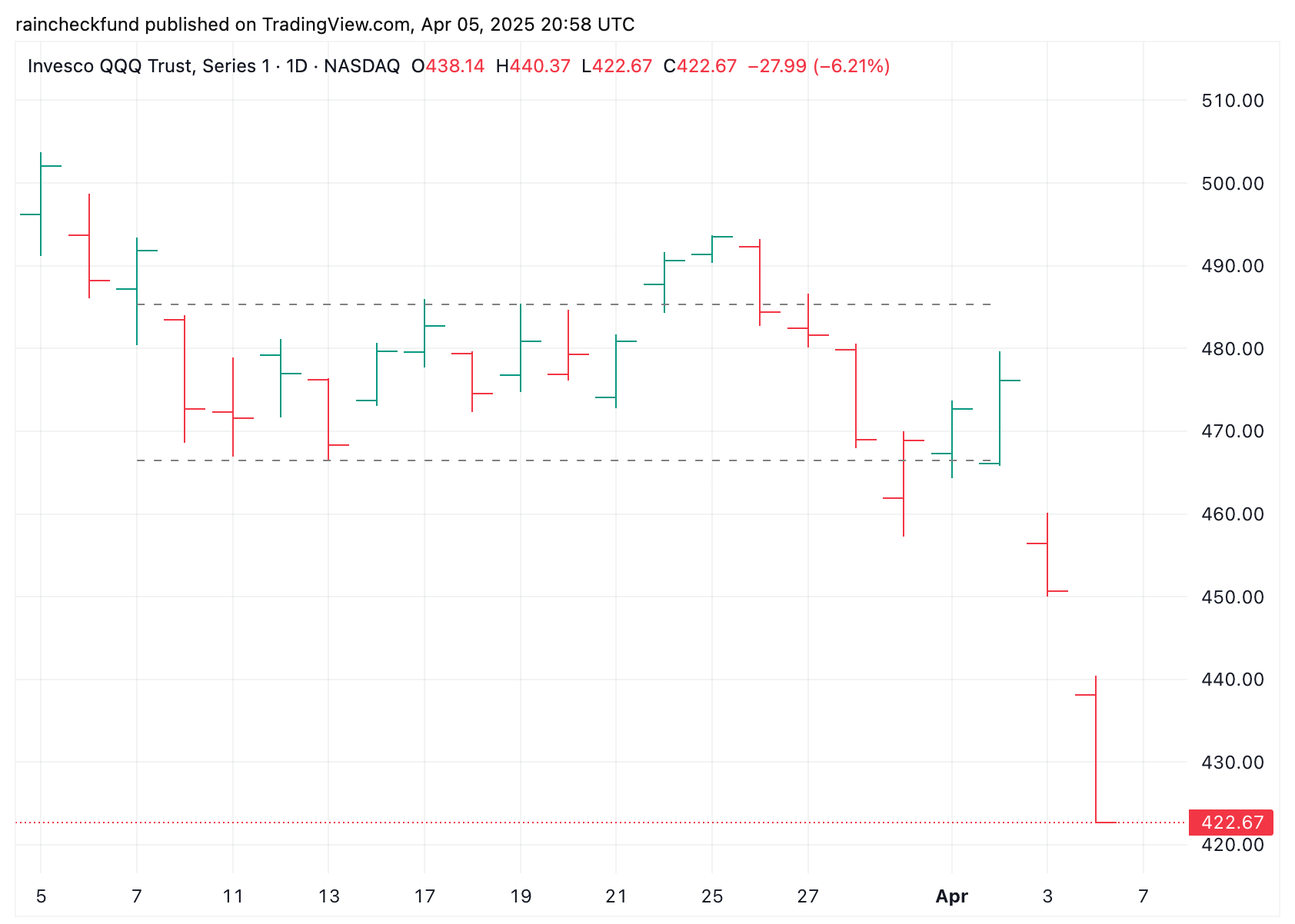

QQQ fell nearly 12% in the last 2 daysMarket Signal: -8 STRONG BEARISH

The Market Signal entered STRONG BEARISH range this week, and stayed there, ending the week at a -8.

The last time the Market Signal was this bearish was in 2022, when QQQ had an annual return of -32.49%.

We are not out of the woods yet, and the current downtrend may be far from over.

“The Smoot-Hawley Tariff Act, enacted in 1930, worsened the Great Depression by raising tariffs on imports, prompting retaliatory tariffs from other countries, and significantly reducing global trade, which further crippled already struggling economies.”

34% of NASDAQ-100 (QQQ) holdings closed at 52-week lows - collectively, these companies make up 26.3% of the index by weight.

NASDAQ-100 52-week lows

The following NASDAQ-100 (QQQ) holdings closed at a 52-week low today:

MSFT $359.84 -3.56%GOOG $147.74 -3.20%GOOGL $145.60 -3.40%ASML $605.55 -2.84%ADBE $349.07 -4.95%QCOM $127.46 -8.58%AMD $85.76 -8.57%TXN $151.39 -7.80%AMAT $126.95 -6.32%ADI $164.60-9.00%KLAC $576.53-7.13%LRCX $59.09-9.40%MU $64.72-12.94%ABNB $106.66-6.41%CDNS $232.88-6.44%REGN $573.45-6.09%SNPS $388.13-7.09%CSX $27.21-2.79%MRVL $49.43-11.16%NXPI $160.81-6.44%FANG $123.37-12.68%ODFL $152.06-2.37%IDXX $393.73-4.15%DDOG $87.93-6.92%GEHC $60.51-15.96%ANSS $286.85-7.60%DXCM $59.83-3.19%TTD $46.24-5.79%MCHP $36.22-11.03%CDW $144.49-4.67%BIIB $122.98-5.91%GFS $31.54-8.23%ON $33.70-5.23%MDB $154.39-5.48%

SQQQ (the inverse triple-leveraged (-3x) ETF for the NASDAQ-100) will be used in place of TQQQ in the next two sections benchmarking against QQQ and its holdings.📉26th day of downtrend

Day 📉1 of current downtrend occurred on Fri. Feb. 28th 2025.

QQQ-16.83% since start of current downtrendSQQQ+60.38% since start of current downtrend

| A | B | C | D | E | F | G | |

|---|---|---|---|---|---|---|---|

|

1

|

Market Signal | Trend Count | QQQ Close | QQQ %chg since 📉1 | SQQQ close | SQQQ %chg since 📉1 | Date |

|

2

|

-2 | 📉1 | $508.17 | 0.00% | $31.40 | 0.00% | Fri 2/28/25 |

|

3

|

-3 | 📉2 | $497.05 | -2.19% | $33.43 | 6.46% | Mon 3/3/25 |

|

4

|

-3 | 📉3 | $495.55 | -2.48% | $33.81 | 7.68% | Tue 3/4/25 |

|

5

|

-3 | 📉4 | $502.01 | -1.21% | $32.51 | 3.54% | Wed 3/5/25 |

|

6

|

-3 | 📉5 | $488.20 | -3.93% | $35.17 | 12.01% | Thu 3/6/25 |

|

7

|

-3 | 📉6 | $491.79 | -3.22% | $34.47 | 9.78% | Fri 3/7/25 |

|

8

|

-3 | 📉7 | $472.73 | -6.97% | $38.37 | 22.20% | Mon 3/10/25 |

|

9

|

-3 | 📉8 | $471.60 | -7.20% | $38.80 | 23.57% | Tue 3/11/25 |

|

10

|

-3 | 📉9 | $476.92 | -6.15% | $37.49 | 19.39% | Wed 3/12/25 |

|

11

|

-3 | 📉10 | $468.34 | -7.84% | $39.54 | 25.92% | Thu 3/13/25 |

|

12

|

-3 | 📉11 | $479.66 | -5.61% | $36.73 | 16.97% | Fri 3/14/25 |

|

13

|

-3 | 📉12 | $482.77 | -5.00% | $36.02 | 14.71% | Mon 3/17/25 |

|

14

|

-3 | 📉13 | $474.54 | -6.62% | $37.84 | 20.51% | Tue 3/18/25 |

|

15

|

-2 | 📉14 | $480.89 | -5.37% | $36.40 | 15.92% | Wed 3/19/25 |

|

16

|

-2 | 📉15 | $479.26 | -5.69% | $36.75 | 17.04% | Thu 3/20/25 |

|

17

|

-2 | 📉16 | $480.84 | -5.38% | $36.40 | 15.92% | Fri 3/21/25 |

|

18

|

-2 | 📉17 | $490.66 | -3.45% | $34.13 | 8.69% | Mon 3/24/25 |

|

19

|

-2 | 📉18 | $493.46 | -2.89% | $33.52 | 6.75% | Tue 3/25/25 |

|

20

|

-2 | 📉19 | $484.38 | -4.68% | $34.86 | 11.02% | Wed 3/26/25 |

|

21

|

-3 | 📉20 | $481.62 | -5.22% | $35.47 | 12.96% | Thu 3/27/25 |

|

22

|

-3 | 📉21 | $468.94 | -7.72% | $38.30 | 21.97% | Fri 3/28/25 |

|

23

|

-7 | 📉22 | $468.92 | -7.72% | $38.34 | 22.10% | Mon 3/31/25 |

|

24

|

-7 | 📉23 | $472.70 | -6.98% | $37.44 | 19.24% | Tue 4/1/25 |

|

25

|

-7 | 📉24 | $476.15 | -6.30% | $36.60 | 16.56% | Wed 4/2/25 |

|

26

|

-8 | 📉25 | $450.66 | -11.32% | $42.53 | 35.45% | Thu 4/3/25 |

|

27

|

-8 | 📉26 | $422.67 | -16.83% | $50.36 | 60.38% | Fri 4/4/25 |

Market Signal, Trend Count, closing prices, and return (%) over current downtrend

SQQQ vs QQQ Holdings

SQQQ is outperforming 100% of QQQ holdings since day 📉1 of current downtrend (Feb. 28th 2025).

Other than MSTR, SQQQ has outperformed all other holdings by more than 10x during this time.

SQQQ has outperformed QQQ by a whopping +77.21% over the current downtrend.

| A | B | C | D | E | |

|---|---|---|---|---|---|

|

1

|

Market Cap | Symbol | %Chg since 📉1 | Close on 📉1 | Close |

|

2

|

153,324 M | QQQ | -16.83% | $508.17 | $422.67 |

|

3

|

1,737 M | SQQQ | 60.38% | $31.40 | $50.36 |

|

4

|

76,473 M | MSTR | 14.95% | $255.43 | $293.61 |

|

5

|

35,272 M | EA | 4.82% | $129.12 | $135.34 |

|

6

|

55,548 M | MNST | 4.45% | $54.65 | $57.08 |

|

7

|

85,774 M | MDLZ | 3.24% | $64.23 | $66.31 |

|

8

|

45,782 M | EXC | 2.60% | $44.20 | $45.35 |

|

9

|

79,557 M | ORLY | 1.18% | $1,373.64 | $1,389.87 |

|

10

|

45,872 M | KDP | 0.87% | $33.52 | $33.81 |

|

11

|

52,662 M | CPRT | -0.53% | $54.80 | $54.51 |

|

12

|

122,016 M | VRTX | -1.08% | $479.79 | $474.62 |

|

13

|

55,791 M | AEP | -1.48% | $106.05 | $104.48 |

|

14

|

42,676 M | FAST | -1.73% | $75.73 | $74.42 |

|

15

|

38,616 M | CCEP | -2.70% | $86.26 | $83.93 |

|

16

|

35,420 M | KHC | -3.35% | $30.71 | $29.68 |

|

17

|

39,977 M | VRSK | -4.01% | $296.91 | $284.99 |

|

18

|

158,148 M | AMGN | -4.44% | $308.06 | $294.39 |

|

19

|

201,048 M | PEP | -4.47% | $153.47 | $146.61 |

|

20

|

30,628 M | CSGP | -4.76% | $76.25 | $72.62 |

|

21

|

51,623 M | PAYX | -5.51% | $151.67 | $143.32 |

|

22

|

39,006 M | XEL | -5.84% | $72.10 | $67.89 |

|

23

|

38,608 M | AXON | -5.93% | $528.45 | $497.13 |

|

24

|

133,702 M | GILD | -6.18% | $114.31 | $107.25 |

|

25

|

207,116 M | LIN | -6.23% | $467.05 | $437.96 |

|

26

|

48,042 M | CHTR | -6.95% | $363.57 | $338.29 |

|

27

|

126,211 M | CMCSA | -6.97% | $35.88 | $33.38 |

|

28

|

63,882 M | CDNS | -7.03% | $250.50 | $232.88 |

|

29

|

42,849 M | ROST | -7.13% | $140.32 | $130.31 |

|

30

|

58,181 M | ROP | -7.31% | $584.50 | $541.80 |

|

31

|

283,278 M | TMUS | -8.00% | $269.69 | $248.11 |

|

32

|

34,343 M | TTWO | -8.21% | $211.98 | $194.58 |

|

33

|

76,853 M | CTAS | -8.27% | $207.50 | $190.33 |

|

34

|

144,724 M | PDD | -8.34% | $113.69 | $104.21 |

|

35

|

156,982 M | INTU | -8.52% | $613.84 | $561.53 |

|

36

|

116,418 M | ADP | -9.22% | $315.18 | $286.13 |

|

37

|

2,675,044 M | MSFT | -9.36% | $396.99 | $359.84 |

|

38

|

31,908 M | IDXX | -9.92% | $437.11 | $393.73 |

|

39

|

212,251 M | AZN | -10.17% | $76.21 | $68.46 |

|

40

|

124,128 M | HON | -10.29% | $212.89 | $190.99 |

|

41

|

52,294 M | ADSK | -10.47% | $274.21 | $245.51 |

|

42

|

27,026 M | ZS | -10.99% | $196.23 | $174.67 |

|

43

|

18,001 M | BIIB | -12.47% | $140.50 | $122.98 |

|

44

|

406,627 M | COST | -12.60% | $1,048.61 | $916.48 |

|

45

|

366,100 M | NFLX | -12.72% | $980.56 | $855.86 |

|

46

|

173,580 M | PLTR | -12.85% | $84.92 | $74.01 |

|

47

|

93,349 M | MELI | -13.22% | $2,121.87 | $1,841.29 |

|

48

|

32,320 M | ODFL | -13.85% | $176.50 | $152.06 |

|

49

|

25,143 M | ANSS | -13.92% | $333.25 | $286.85 |

|

50

|

139,329 M | AMD | -14.12% | $99.86 | $85.76 |

|

51

|

1,800,951 M | GOOG | -14.21% | $172.22 | $147.74 |

|

52

|

1,774,864 M | GOOGL | -14.49% | $170.28 | $145.60 |

|

53

|

140,581 M | BKNG | -14.59% | $5,016.01 | $4,284.02 |

|

54

|

238,102 M | ASML | -14.60% | $709.08 | $605.55 |

|

55

|

216,976 M | CSCO | -14.93% | $64.11 | $54.54 |

|

56

|

51,284 M | CSX | -15.00% | $32.01 | $27.21 |

|

57

|

60,013 M | SNPS | -15.12% | $457.28 | $388.13 |

|

58

|

47,706 M | PCAR | -15.26% | $107.24 | $90.88 |

|

59

|

86,558 M | INTC | -16.35% | $23.73 | $19.85 |

|

60

|

79,724 M | CRWD | -17.46% | $389.66 | $321.63 |

|

61

|

34,000 M | CTSH | -17.51% | $83.33 | $68.74 |

|

62

|

57,759 M | WDAY | -17.54% | $263.34 | $217.14 |

|

63

|

68,543 M | DASH | -17.78% | $198.44 | $163.16 |

|

64

|

57,742 M | PYPL | -17.85% | $71.05 | $58.37 |

|

65

|

62,692 M | REGN | -17.93% | $698.74 | $573.45 |

|

66

|

770,131 M | TSLA | -18.28% | $292.98 | $239.43 |

|

67

|

17,439 M | GFS | -18.65% | $38.77 | $31.54 |

|

68

|

76,613 M | KLAC | -18.67% | $708.84 | $576.53 |

|

69

|

140,971 M | QCOM | -18.90% | $157.17 | $127.46 |

|

70

|

19,144 M | CDW | -18.92% | $178.20 | $144.49 |

|

71

|

101,679 M | PANW | -19.36% | $190.43 | $153.57 |

|

72

|

1,812,212 M | AMZN | -19.45% | $212.28 | $171.00 |

|

73

|

103,139 M | AMAT | -19.69% | $158.07 | $126.95 |

|

74

|

148,774 M | ADBE | -20.41% | $438.56 | $349.07 |

|

75

|

35,068 M | BKR | -20.59% | $44.59 | $35.41 |

|

76

|

161,790 M | ISRG | -21.21% | $573.15 | $451.58 |

|

77

|

65,140 M | FTNT | -21.57% | $108.01 | $84.71 |

|

78

|

2,829,858 M | AAPL | -22.11% | $241.84 | $188.38 |

|

79

|

35,708 M | FANG | -22.39% | $158.96 | $123.37 |

|

80

|

137,752 M | TXN | -22.76% | $195.99 | $151.39 |

|

81

|

75,852 M | LRCX | -23.00% | $76.74 | $59.09 |

|

82

|

66,272 M | ABNB | -23.19% | $138.87 | $106.66 |

|

83

|

59,089 M | MAR | -23.49% | $280.45 | $214.58 |

|

84

|

1,278,814 M | META | -24.46% | $668.20 | $504.73 |

|

85

|

2,301,164 M | NVDA | -24.50% | $124.92 | $94.31 |

|

86

|

30,139 M | DDOG | -24.56% | $116.55 | $87.93 |

|

87

|

40,785 M | NXPI | -25.41% | $215.59 | $160.81 |

|

88

|

687,848 M | AVGO | -26.65% | $199.43 | $146.29 |

|

89

|

31,812 M | LULU | -27.87% | $365.61 | $263.70 |

|

90

|

14,223 M | ON | -28.37% | $47.05 | $33.70 |

|

91

|

81,638 M | ADI | -28.45% | $230.06 | $164.60 |

|

92

|

93,260 M | SBUX | -29.11% | $115.81 | $82.10 |

|

93

|

19,810 M | WBD | -29.58% | $11.46 | $8.07 |

|

94

|

27,671 M | GEHC | -30.73% | $87.35 | $60.51 |

|

95

|

72,329 M | MU | -30.88% | $93.63 | $64.72 |

|

96

|

53,563 M | CEG | -31.76% | $250.55 | $170.96 |

|

97

|

23,460 M | DXCM | -32.30% | $88.37 | $59.83 |

|

98

|

74,577 M | APP | -32.65% | $325.74 | $219.37 |

|

99

|

92,446 M | ARM | -33.40% | $131.69 | $87.71 |

|

100

|

49,170 M | TEAM | -33.98% | $284.26 | $187.67 |

|

101

|

22,939 M | TTD | -34.24% | $70.32 | $46.24 |

|

102

|

19,480 M | MCHP | -38.46% | $58.86 | $36.22 |

|

103

|

12,535 M | MDB | -42.27% | $267.43 | $154.39 |

|

104

|

42,810 M | MRVL | -46.17% | $91.82 | $49.43 |