Feb. 28th 2025

Market Signal goes negative

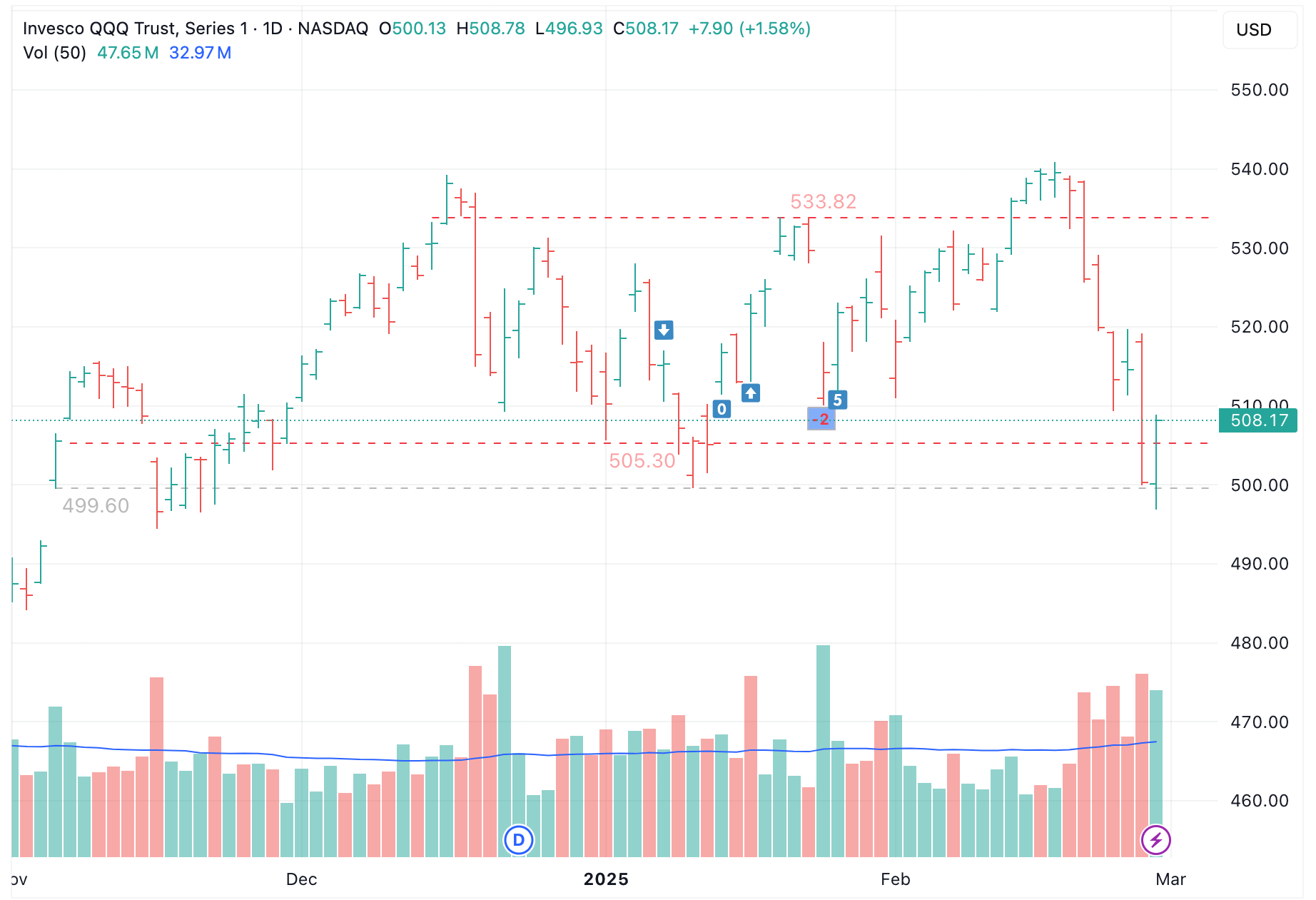

Market Signal: -2 NEUTRAL/WEAK BEARISH

The NASDAQ-100 (QQQ) dropped sharply this week. Despite QQQ bouncing off support and trading back in the prior consolidation range, the Market Signal went negative on Friday.

All investing strategies involve risk. Drawdowns occur. Over the 100 day uptrend from Thurs. Aug. 15th 2024 to Tues. Jan. 7th 2025 , TQQQ experienced a -16.75% drawdown, before concluding the uptrend for a +17.85% return. It's important to note over that time frame, the Market Signal did not go negative.

The Market Signal dropping to -2 on Friday indicates the current uptrend is poised to end. Another day of negative Market Signal on Mon. March 3rd would indicate the start of a downtrend, suggesting to exit TQQQ positions altogether (some might consider SQQQ).

QQQ bounced off support, trading back in the prior consolidation range on Fri. Feb. 28 NASDAQ-100 52-week highs

The following NASDAQ-100 (QQQ) holdings closed at a 52-week high today:

GILD $114.31 +2.07%SBUX $115.81 +1.15%ADP $315.18 +1.25%ORLY $1,373.64 +1.49%PAYX $151.67 +1.96%EXC $44.20 +0.94%

📈29th* day of uptrend

*Given Fri. Feb. 28th's negative Market Signal value, if the next trading day returns negative Market Signal value, that would effectively make Thurs. Feb. 27th the last day of a 28 day uptrend, and Fri. Feb. 28th. the first day of a new downtrend.

Day 📈1 of current uptrend occurred on Jan. 17th 2025.

QQQ-2.60% since start of current uptrendTQQQ-9.89% since start of current uptrend

| A | B | C | D | E | F | G | |

|---|---|---|---|---|---|---|---|

|

1

|

Market Signal | Trend Count | QQQ Close | QQQ %chg since 📈1 | TQQQ close | TQQQ %chg since 📈1 | Date |

|

2

|

1 | 📈1 | $521.74 | 0.00% | $83.14 | 0.00% | Fri 1/17/25 |

|

3

|

1 | 📈2 | $524.80 | 0.59% | $84.54 | 1.68% | Tue 1/21/25 |

|

4

|

1 | 📈3 | $531.51 | 1.87% | $87.80 | 5.61% | Wed 1/22/25 |

|

5

|

1 | 📈4 | $532.64 | 2.09% | $88.34 | 6.25% | Thu 1/23/25 |

|

6

|

1 | 📈5 | $529.63 | 1.51% | $86.75 | 4.34% | Fri 1/24/25 |

|

7

|

-2 | 📈6* | $514.21 | -1.44% | $79.14 | -4.81% | Mon 1/27/25 |

|

8

|

5 | 📈7 | $521.81 | 0.01% | $82.65 | -0.59% | Tue 1/28/25 |

|

9

|

4 | 📈8 | $520.83 | -0.17% | $82.14 | -1.20% | Wed 1/29/25 |

|

10

|

4 | 📈9 | $523.05 | 0.25% | $83.17 | 0.04% | Thu 1/30/25 |

|

11

|

4 | 📈10 | $522.29 | 0.11% | $82.72 | -0.51% | Fri 1/31/25 |

|

12

|

3 | 📈11 | $518.11 | -0.70% | $80.72 | -2.91% | Mon 2/3/25 |

|

13

|

6 | 📈12 | $524.47 | 0.52% | $83.65 | 0.61% | Tue 2/4/25 |

|

14

|

6 | 📈13 | $526.85 | 0.98% | $84.74 | 1.92% | Wed 2/5/25 |

|

15

|

6 | 📈14 | $529.60 | 1.51% | $86.01 | 3.45% | Thu 2/6/25 |

|

16

|

5 | 📈15 | $522.92 | 0.23% | $82.73 | -0.49% | Fri 2/7/25 |

|

17

|

6 | 📈16 | $529.25 | 1.44% | $85.64 | 3.01% | Mon 2/10/25 |

|

18

|

5 | 📈17 | $527.99 | 1.20% | $85.03 | 2.27% | Tue 2/11/25 |

|

19

|

5 | 📈18 | $528.30 | 1.26% | $85.20 | 2.48% | Wed 2/12/25 |

|

20

|

6 | 📈19 | $535.90 | 2.71% | $88.79 | 6.80% | Thu 2/13/25 |

|

21

|

7 | 📈20 | $538.15 | 3.15% | $89.83 | 8.05% | Fri 2/14/25 |

|

22

|

5 | 📈21 | $539.37 | 3.38% | $90.39 | 8.72% | Tue 2/18/25 |

|

23

|

5 | 📈22 | $539.52 | 3.41% | $90.40 | 8.73% | Wed 2/19/25 |

|

24

|

5 | 📈23 | $537.23 | 2.97% | $89.30 | 7.41% | Thu 2/20/25 |

|

25

|

4 | 📈24 | $526.08 | 0.83% | $83.71 | 0.69% | Fri 2/21/25 |

|

26

|

2 | 📈25 | $519.87 | -0.36% | $80.70 | -2.93% | Mon 2/24/25 |

|

27

|

2 | 📈26 | $513.32 | -1.61% | $77.62 | -6.64% | Tue 2/25/25 |

|

28

|

2 | 📈27 | $514.56 | -1.38% | $78.12 | -6.04% | Wed 2/26/25 |

|

29

|

1 | 📈28 | $500.27 | -4.12% | $71.64 | -13.83% | Thu 2/27/25 |

|

30

|

-2 | 📈29* | $508.17 | -2.60% | $74.92 | -9.89% | Fri 2/28/25 |

Market Signal, Trend Count, closing prices, and return (%) over current uptrend

*Uptrend persists, as a new downtrend calls for consecutive days of negative Market Signal values, which did not occur.

TQQQ vs QQQ Holdings

TQQQ is outperforming 19% of QQQ holdings since day 📈1 of current uptrend (Jan. 17th 2025).

| A | B | C | D | E | |

|---|---|---|---|---|---|

|

1

|

Market Cap | Symbol | %Chg since 📈1 | Close on 📈1 | Close |

|

2

|

184,339 M | QQQ | -2.60% | $521.74 | $508.17 |

|

3

|

142,461 M | GILD | 24.47% | $91.84 | $114.31 |

|

4

|

307,917 M | TMUS | 23.16% | $218.97 | $269.69 |

|

5

|

131,552 M | SBUX | 21.74% | $95.13 | $115.81 |

|

6

|

28,132 M | WBD | 20.38% | $9.52 | $11.46 |

|

7

|

199,168 M | PLTR | 18.32% | $71.77 | $84.92 |

|

8

|

107,573 M | MELI | 15.57% | $1,836.00 | $2,121.87 |

|

9

|

83,057 M | FTNT | 14.62% | $94.23 | $108.01 |

|

10

|

236,272 M | AZN | 14.43% | $66.60 | $76.21 |

|

11

|

419,442 M | NFLX | 14.27% | $858.10 | $980.56 |

|

12

|

83,364 M | DASH | 13.73% | $174.48 | $198.44 |

|

13

|

37,414 M | TTWO | 13.72% | $186.41 | $211.98 |

|

14

|

123,205 M | VRTX | 13.69% | $422.00 | $479.79 |

|

15

|

165,491 M | AMGN | 13.21% | $272.11 | $308.06 |

|

16

|

78,822 M | ORLY | 12.89% | $1,216.79 | $1,373.64 |

|

17

|

74,476 M | TEAM | 12.64% | $252.36 | $284.26 |

|

18

|

44,431 M | EXC | 12.13% | $39.42 | $44.20 |

|

19

|

39,724 M | CCEP | 11.92% | $77.07 | $86.26 |

|

20

|

62,767 M | ROP | 11.90% | $522.32 | $584.50 |

|

21

|

465,477 M | COST | 11.18% | $943.19 | $1,048.61 |

|

22

|

83,083 M | MDLZ | 11.01% | $57.86 | $64.23 |

|

23

|

53,179 M | MNST | 10.58% | $49.42 | $54.65 |

|

24

|

102,751 M | INTC | 10.42% | $21.49 | $23.73 |

|

25

|

95,978 M | CRWD | 9.15% | $357.00 | $389.66 |

|

26

|

56,547 M | AEP | 9.05% | $97.25 | $106.05 |

|

27

|

1,692,991 M | META | 9.05% | $612.77 | $668.20 |

|

28

|

41,425 M | XEL | 8.06% | $66.72 | $72.10 |

|

29

|

157,889 M | PDD | 7.69% | $105.57 | $113.69 |

|

30

|

126,084 M | PANW | 7.52% | $177.11 | $190.43 |

|

31

|

220,873 M | LIN | 7.12% | $436.00 | $467.05 |

|

32

|

41,216 M | CTSH | 7.09% | $77.81 | $83.33 |

|

33

|

41,649 M | VRSK | 6.59% | $278.55 | $296.91 |

|

34

|

255,048 M | CSCO | 6.44% | $60.23 | $64.11 |

|

35

|

128,238 M | ADP | 6.42% | $296.18 | $315.18 |

|

36

|

45,478 M | KDP | 6.01% | $31.62 | $33.52 |

|

37

|

21,430 M | MDB | 5.66% | $253.11 | $267.43 |

|

38

|

70,048 M | WDAY | 5.49% | $249.64 | $263.34 |

|

39

|

3,632,938 M | AAPL | 5.16% | $229.98 | $241.84 |

|

40

|

114,104 M | ADI | 4.97% | $219.16 | $230.06 |

|

41

|

36,698 M | KHC | 4.92% | $29.27 | $30.71 |

|

42

|

34,533 M | DXCM | 4.73% | $84.38 | $88.37 |

|

43

|

83,735 M | CTAS | 4.63% | $198.31 | $207.50 |

|

44

|

30,109 M | ZS | 4.61% | $187.58 | $196.23 |

|

45

|

35,549 M | IDXX | 4.26% | $419.26 | $437.11 |

|

46

|

54,611 M | PAYX | 3.68% | $146.29 | $151.67 |

|

47

|

210,484 M | PEP | 3.52% | $148.25 | $153.47 |

|

48

|

51,608 M | CHTR | 3.47% | $351.37 | $363.57 |

|

49

|

31,272 M | CSGP | 3.25% | $73.85 | $76.25 |

|

50

|

39,945 M | GEHC | 3.08% | $84.74 | $87.35 |

|

51

|

86,285 M | ABNB | 2.78% | $135.12 | $138.87 |

|

52

|

76,390 M | REGN | 2.52% | $681.58 | $698.74 |

|

53

|

190,909 M | ADBE | 1.99% | $429.99 | $438.56 |

|

54

|

178,416 M | TXN | 1.86% | $192.42 | $195.99 |

|

55

|

164,601 M | BKNG | 1.81% | $4,926.80 | $5,016.01 |

|

56

|

171,606 M | INTU | 1.61% | $604.13 | $613.84 |

|

57

|

31,656 M | MCHP | 1.54% | $57.97 | $58.86 |

|

58

|

77,319 M | MAR | 1.18% | $277.18 | $280.45 |

|

59

|

54,678 M | NXPI | 0.11% | $215.36 | $215.59 |

|

60

|

20,566 M | BIIB | -0.04% | $140.55 | $140.50 |

|

61

|

43,427 M | FAST | -0.46% | $76.08 | $75.73 |

|

62

|

135,663 M | CMCSA | -1.91% | $36.58 | $35.88 |

|

63

|

44,525 M | LULU | -2.16% | $373.70 | $365.61 |

|

64

|

60,647 M | CSX | -2.20% | $32.73 | $32.01 |

|

65

|

56,280 M | PCAR | -2.80% | $110.33 | $107.24 |

|

66

|

204,418 M | ISRG | -3.29% | $592.64 | $573.15 |

|

67

|

52,942 M | CPRT | -3.69% | $56.90 | $54.80 |

|

68

|

44,149 M | BKR | -4.19% | $46.54 | $44.59 |

|

69

|

138,361 M | HON | -4.35% | $222.58 | $212.89 |

|

70

|

98,508 M | LRCX | -4.43% | $80.30 | $76.74 |

|

71

|

173,830 M | QCOM | -4.49% | $164.56 | $157.17 |

|

72

|

29,210 M | ANSS | -4.77% | $349.93 | $333.25 |

|

73

|

110,738 M | APP | -4.85% | $342.34 | $325.74 |

|

74

|

23,610 M | CDW | -5.58% | $188.73 | $178.20 |

|

75

|

59,095 M | ADSK | -5.92% | $291.45 | $274.21 |

|

76

|

46,296 M | ROST | -5.92% | $149.15 | $140.32 |

|

77

|

2,249,686 M | AMZN | -6.05% | $225.94 | $212.28 |

|

78

|

278,810 M | ASML | -6.25% | $756.33 | $709.08 |

|

79

|

94,195 M | KLAC | -6.42% | $757.47 | $708.84 |

|

80

|

37,514 M | ODFL | -6.88% | $189.55 | $176.50 |

|

81

|

2,951,217 M | MSFT | -7.47% | $429.03 | $396.99 |

|

82

|

33,651 M | EA | -9.07% | $142.00 | $129.12 |

|

83

|

3,048,048 M | NVDA | -9.29% | $137.71 | $124.92 |

|

84

|

38,202 M | TQQQ | -9.89% | $83.14 | $74.92 |

|

85

|

21,426 M | GFS | -10.05% | $43.10 | $38.77 |

|

86

|

40,297 M | AXON | -11.02% | $593.89 | $528.45 |

|

87

|

104,320 M | MU | -11.46% | $105.75 | $93.63 |

|

88

|

138,801 M | ARM | -11.77% | $149.26 | $131.69 |

|

89

|

46,010 M | FANG | -11.78% | $180.18 | $158.96 |

|

90

|

2,099,362 M | GOOG | -12.82% | $197.55 | $172.22 |

|

91

|

2,075,713 M | GOOGL | -13.12% | $196.00 | $170.28 |

|

92

|

70,705 M | SNPS | -13.18% | $526.70 | $457.28 |

|

93

|

19,828 M | ON | -13.88% | $54.63 | $47.05 |

|

94

|

39,949 M | DDOG | -15.79% | $138.40 | $116.55 |

|

95

|

934,799 M | AVGO | -16.01% | $237.44 | $199.43 |

|

96

|

128,423 M | AMAT | -17.69% | $192.05 | $158.07 |

|

97

|

161,821 M | AMD | -17.78% | $121.46 | $99.86 |

|

98

|

68,664 M | CDNS | -18.03% | $305.60 | $250.50 |

|

99

|

78,382 M | CEG | -20.80% | $316.36 | $250.55 |

|

100

|

70,286 M | PYPL | -22.61% | $91.81 | $71.05 |

|

101

|

79,452 M | MRVL | -26.40% | $124.76 | $91.82 |

|

102

|

942,375 M | TSLA | -31.31% | $426.50 | $292.98 |

|

103

|

66,485 M | MSTR | -35.58% | $396.50 | $255.43 |

|

104

|

34,885 M | TTD | -43.48% | $124.42 | $70.32 |