Feb. 21st 2025

QQQ tests all-time highs

Market Signal: +4 MODERATE BULLISH

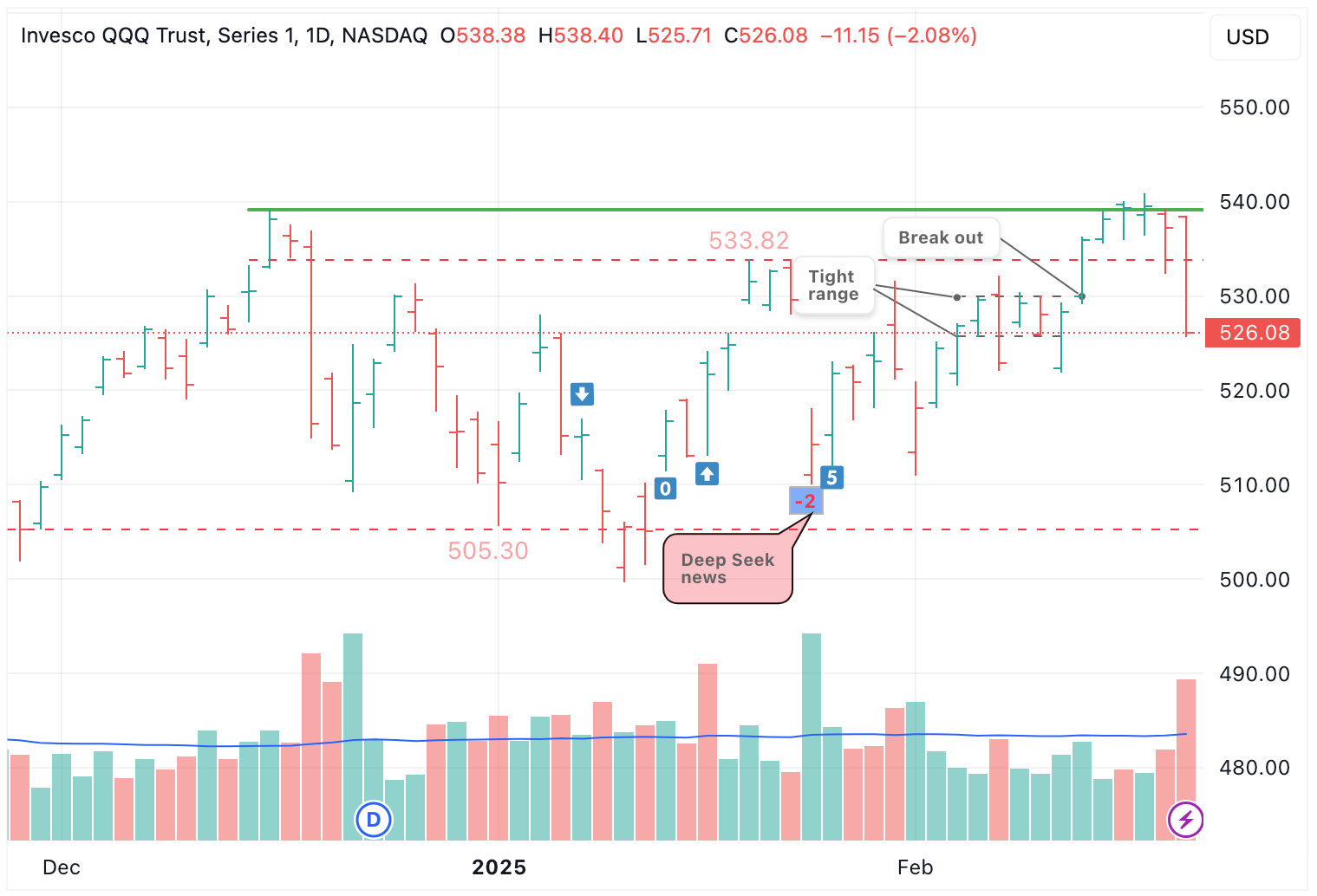

QQQ spent the first two days of the week closing at all-time highs, before pulling back into the prior consolidation range.

Despite a sour end to the week,QQQ still closed higher than the day of Deep Seek news, and higher than the first day of the uptrend.

The uptrend continues, but appears to be weakening. Market Signal dropped to +4 to end the week, the lowest possible MODERATE BULLISH value, before entering NEUTRAL/WEAK BULLISH territory. Be wary.

NASDAQ-100 52-week highs

The following NASDAQ-100 (QQQ) holdings closed at a 52-week high today:

MELI $2,260.00 +7.09%AEP $105.33 +0.94%EXC $43.39 +0.51%CCEP $87.29 +0.85%

📈24th day of uptrend

Day 📈1 of current uptrend occurred on Jan. 17th 2025.

QQQ+0.83% since start of current uptrendTQQQ+0.69% since start of current uptrend

| A | B | C | D | E | F | G | |

|---|---|---|---|---|---|---|---|

|

1

|

Market Signal | Trend Count | QQQ Close | QQQ %chg since 📈1 | TQQQ close | TQQQ %chg since 📈1 | Date |

|

2

|

1 | 📈1 | $521.74 | 0.00% | $83.14 | 0.00% | Fri 1/17/25 |

|

3

|

1 | 📈2 | $524.80 | 0.59% | $84.54 | 1.68% | Tue 1/21/25 |

|

4

|

1 | 📈3 | $531.51 | 1.87% | $87.80 | 5.61% | Wed 1/22/25 |

|

5

|

1 | 📈4 | $532.64 | 2.09% | $88.34 | 6.25% | Thu 1/23/25 |

|

6

|

1 | 📈5 | $529.63 | 1.51% | $86.75 | 4.34% | Fri 1/24/25 |

|

7

|

-2 | 📈6* | $514.21 | -1.44% | $79.14 | -4.81% | Mon 1/27/25 |

|

8

|

5 | 📈7 | $521.81 | 0.01% | $82.65 | -0.59% | Tue 1/28/25 |

|

9

|

4 | 📈8 | $520.83 | -0.17% | $82.14 | -1.20% | Wed 1/29/25 |

|

10

|

4 | 📈9 | $523.05 | 0.25% | $83.17 | 0.04% | Thu 1/30/25 |

|

11

|

4 | 📈10 | $522.29 | 0.11% | $82.72 | -0.51% | Fri 1/31/25 |

|

12

|

3 | 📈11 | $518.11 | -0.70% | $80.72 | -2.91% | Mon 2/3/25 |

|

13

|

6 | 📈12 | $524.47 | 0.52% | $83.65 | 0.61% | Tue 2/4/25 |

|

14

|

6 | 📈13 | $526.85 | 0.98% | $84.74 | 1.92% | Wed 2/5/25 |

|

15

|

6 | 📈14 | $529.60 | 1.51% | $86.01 | 3.45% | Thu 2/6/25 |

|

16

|

5 | 📈15 | $522.92 | 0.23% | $82.73 | -0.49% | Fri 2/7/25 |

|

17

|

6 | 📈16 | $529.25 | 1.44% | $85.64 | 3.01% | Mon 2/10/25 |

|

18

|

5 | 📈17 | $527.99 | 1.20% | $85.03 | 2.27% | Tue 2/11/25 |

|

19

|

5 | 📈18 | $528.30 | 1.26% | $85.20 | 2.48% | Wed 2/12/25 |

|

20

|

6 | 📈19 | $535.90 | 2.71% | $88.79 | 6.80% | Thu 2/13/25 |

|

21

|

7 | 📈20 | $538.15 | 3.15% | $89.83 | 8.05% | Fri 2/14/25 |

|

22

|

5 | 📈21 | $539.37 | 3.38% | $90.39 | 8.72% | Tue 2/18/25 |

|

23

|

5 | 📈22 | $539.52 | 3.41% | $90.40 | 8.73% | Wed 2/19/25 |

|

24

|

5 | 📈23 | $537.23 | 2.97% | $89.30 | 7.41% | Thu 2/20/25 |

|

25

|

4 | 📈24 | $526.08 | 0.83% | $83.71 | 0.69% | Fri 2/21/25 |

Market Signal, Trend Count, closing prices, and return (%) over current uptrend

*Uptrend persists, as a new downtrend calls for consecutive days of negative Market Signal values, which did not occur.

TQQQ vs QQQ Holdings

TQQQ is outperforming 42% of QQQ holdings since day 📈1 of current uptrend (Jan. 17th 2025).

At this time, both QQQ and TQQQ are more or less flat since start of current uptrend.

| A | B | C | D | E | |

|---|---|---|---|---|---|

|

1

|

Market Cap | Symbol | %Chg since 📈1 | Close on 📈1 | Close |

|

2

|

190,836 M | QQQ | 0.83% | $521.74 | $526.08 |

|

3

|

237,702 M | PLTR | 41.21% | $71.77 | $101.35 |

|

4

|

182,401 M | PDD | 24.41% | $105.57 | $131.34 |

|

5

|

114,576 M | MELI | 23.09% | $1,836.00 | $2,260.00 |

|

6

|

141,223 M | APP | 21.32% | $342.34 | $415.31 |

|

7

|

302,757 M | TMUS | 21.10% | $218.97 | $265.17 |

|

8

|

137,027 M | GILD | 19.72% | $91.84 | $109.95 |

|

9

|

126,940 M | SBUX | 17.47% | $95.13 | $111.75 |

|

10

|

429,105 M | NFLX | 16.90% | $858.10 | $1,003.15 |

|

11

|

84,325 M | FTNT | 16.76% | $94.23 | $110.02 |

|

12

|

107,687 M | INTC | 15.73% | $21.49 | $24.87 |

|

13

|

124,348 M | VRTX | 14.75% | $422.00 | $484.24 |

|

14

|

83,994 M | DASH | 14.59% | $174.48 | $199.94 |

|

15

|

100,170 M | CRWD | 13.92% | $357.00 | $406.68 |

|

16

|

37,355 M | TTWO | 13.54% | $186.41 | $211.65 |

|

17

|

74,929 M | TEAM | 13.33% | $252.36 | $285.99 |

|

18

|

40,215 M | CCEP | 13.26% | $77.07 | $87.29 |

|

19

|

26,445 M | WBD | 13.24% | $9.52 | $10.78 |

|

20

|

83,652 M | MDLZ | 11.77% | $57.86 | $64.67 |

|

21

|

1,731,883 M | META | 11.55% | $612.77 | $683.55 |

|

22

|

230,103 M | AZN | 11.44% | $66.60 | $74.22 |

|

23

|

162,778 M | AMGN | 11.36% | $272.11 | $303.01 |

|

24

|

43,616 M | EXC | 10.07% | $39.42 | $43.39 |

|

25

|

61,555 M | ROP | 9.90% | $522.32 | $574.05 |

|

26

|

59,986 M | NXPI | 9.83% | $215.36 | $236.52 |

|

27

|

459,449 M | COST | 9.74% | $943.19 | $1,035.03 |

|

28

|

41,978 M | CTSH | 9.07% | $77.81 | $84.87 |

|

29

|

118,494 M | ADI | 9.01% | $219.16 | $238.91 |

|

30

|

56,163 M | AEP | 8.31% | $97.25 | $105.33 |

|

31

|

90,759 M | ABNB | 8.10% | $135.12 | $146.07 |

|

32

|

37,075 M | IDXX | 7.99% | $419.26 | $452.77 |

|

33

|

21,897 M | MDB | 7.96% | $253.11 | $273.26 |

|

34

|

126,481 M | PANW | 7.86% | $177.11 | $191.03 |

|

35

|

46,174 M | KDP | 7.65% | $31.62 | $34.04 |

|

36

|

41,655 M | GEHC | 7.49% | $84.74 | $91.09 |

|

37

|

51,544 M | MNST | 7.24% | $49.42 | $53.00 |

|

38

|

110,421 M | LRCX | 7.12% | $80.30 | $86.02 |

|

39

|

74,793 M | ORLY | 7.12% | $1,216.79 | $1,303.41 |

|

40

|

3,688,670 M | AAPL | 6.77% | $229.98 | $245.55 |

|

41

|

37,200 M | KHC | 6.35% | $29.27 | $31.13 |

|

42

|

254,531 M | CSCO | 6.23% | $60.23 | $63.98 |

|

43

|

41,673 M | VRSK | 5.95% | $278.55 | $295.11 |

|

44

|

30,467 M | ZS | 5.85% | $187.58 | $198.56 |

|

45

|

32,845 M | MCHP | 5.35% | $57.97 | $61.07 |

|

46

|

34,693 M | DXCM | 5.21% | $84.38 | $88.78 |

|

47

|

218,080 M | LIN | 5.05% | $436.00 | $458.00 |

|

48

|

183,887 M | TXN | 4.98% | $192.42 | $202.00 |

|

49

|

126,439 M | ADP | 4.92% | $296.18 | $310.76 |

|

50

|

40,162 M | XEL | 4.83% | $66.72 | $69.94 |

|

51

|

31,494 M | CSGP | 3.98% | $73.85 | $76.79 |

|

52

|

210,525 M | PEP | 3.54% | $148.25 | $153.50 |

|

53

|

193,417 M | ADBE | 3.33% | $429.99 | $444.32 |

|

54

|

82,496 M | CTAS | 3.09% | $198.31 | $204.43 |

|

55

|

76,563 M | REGN | 2.75% | $681.58 | $700.33 |

|

56

|

51,243 M | CHTR | 2.74% | $351.37 | $361.00 |

|

57

|

68,200 M | WDAY | 2.70% | $249.64 | $256.39 |

|

58

|

53,473 M | PAYX | 1.52% | $146.29 | $148.51 |

|

59

|

163,769 M | BKNG | 1.30% | $4,926.80 | $4,990.64 |

|

60

|

42,684 M | TQQQ | 0.69% | $83.14 | $83.71 |

|

61

|

182,966 M | QCOM | 0.53% | $164.56 | $165.43 |

|

62

|

76,497 M | MAR | 0.10% | $277.18 | $277.47 |

|

63

|

20,586 M | BIIB | 0.06% | $140.55 | $140.64 |

|

64

|

211,066 M | ISRG | -0.14% | $592.64 | $591.79 |

|

65

|

100,236 M | KLAC | -0.42% | $757.47 | $754.30 |

|

66

|

54,526 M | CPRT | -0.54% | $56.90 | $56.59 |

|

67

|

137,024 M | CMCSA | -0.93% | $36.58 | $36.24 |

|

68

|

22,778 M | ON | -1.06% | $54.63 | $54.05 |

|

69

|

24,854 M | CDW | -1.18% | $188.73 | $186.50 |

|

70

|

62,288 M | CSX | -1.31% | $32.73 | $32.30 |

|

71

|

23,449 M | GFS | -1.55% | $43.10 | $42.43 |

|

72

|

42,880 M | FAST | -1.71% | $76.08 | $74.78 |

|

73

|

45,169 M | BKR | -1.98% | $46.54 | $45.62 |

|

74

|

61,420 M | ADSK | -2.21% | $291.45 | $285.00 |

|

75

|

3,292,191 M | NVDA | -2.38% | $137.71 | $134.43 |

|

76

|

289,871 M | ASML | -2.53% | $756.33 | $737.21 |

|

77

|

152,661 M | ARM | -2.96% | $149.26 | $144.84 |

|

78

|

43,717 M | LULU | -3.94% | $373.70 | $358.97 |

|

79

|

2,295,256 M | AMZN | -4.14% | $225.94 | $216.58 |

|

80

|

29,294 M | ANSS | -4.49% | $349.93 | $334.21 |

|

81

|

137,744 M | HON | -4.78% | $222.58 | $211.94 |

|

82

|

38,515 M | ODFL | -4.83% | $189.55 | $180.40 |

|

83

|

3,034,626 M | MSFT | -4.85% | $429.03 | $408.21 |

|

84

|

54,821 M | PCAR | -5.32% | $110.33 | $104.46 |

|

85

|

158,285 M | INTU | -6.40% | $604.13 | $565.47 |

|

86

|

110,125 M | MU | -6.53% | $105.75 | $98.84 |

|

87

|

34,128 M | EA | -7.78% | $142.00 | $130.95 |

|

88

|

1,024,937 M | AVGO | -7.91% | $237.44 | $218.66 |

|

89

|

2,213,460 M | GOOG | -8.08% | $197.55 | $181.58 |

|

90

|

2,190,055 M | GOOGL | -8.34% | $196.00 | $179.66 |

|

91

|

45,072 M | ROST | -8.41% | $149.15 | $136.61 |

|

92

|

179,614 M | AMD | -8.74% | $121.46 | $110.84 |

|

93

|

73,419 M | SNPS | -9.85% | $526.70 | $474.84 |

|

94

|

88,986 M | CEG | -10.09% | $316.36 | $284.44 |

|

95

|

139,724 M | AMAT | -10.45% | $192.05 | $171.98 |

|

96

|

45,585 M | FANG | -13.35% | $180.18 | $156.12 |

|

97

|

41,008 M | DDOG | -13.55% | $138.40 | $119.64 |

|

98

|

39,135 M | AXON | -13.58% | $593.89 | $513.22 |

|

99

|

70,813 M | CDNS | -15.46% | $305.60 | $258.34 |

|

100

|

89,827 M | MRVL | -16.79% | $124.76 | $103.81 |

|

101

|

74,144 M | PYPL | -18.36% | $91.81 | $74.95 |

|

102

|

1,086,539 M | TSLA | -20.80% | $426.50 | $337.80 |

|

103

|

77,374 M | MSTR | -24.42% | $396.50 | $299.69 |

|

104

|

35,567 M | TTD | -42.08% | $124.42 | $72.06 |