Feb. 14th 2025

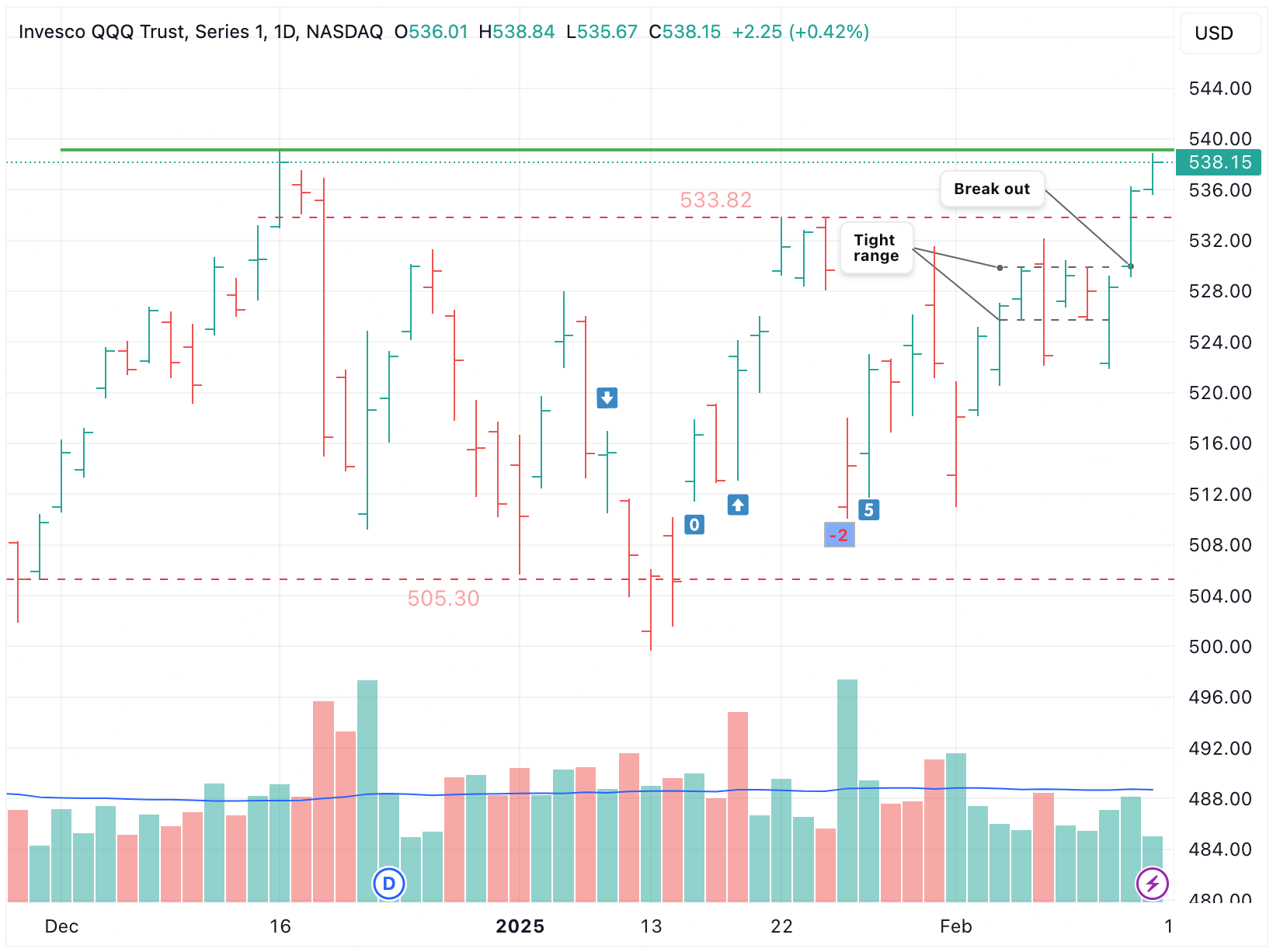

QQQ breaks out following tight range; ends week near all-time high

Market Signal: +6 MODERATE BULLISH

Amid broader consolidation, QQQ traded in tight range this week, before breaking out on Thursday.

Friday offered confirmation, with QQQ closing higher at $515.38, within 2 cents of it's all-time highest close.

A close above the $533.82 level has not been seen in nearly two months - prior to the December 18th pullback.

The Market Signal was in MODERATE BULLISH range the entire week, and 10% of NASDAQ-100 (QQQ) holdings index closed at 52 week highs on Friday:

NASDAQ-100 52-week highs

The following NASDAQ-100 (QQQ) holdings closed at a 52-week high today:

META $736.67 +1.11%NFLX $1,058.60 +1.43%TMUS $270.82 +2.16%PLTR $119.16 +1.06%CSCO $64.87 +1.61%APP $510.13 +8.15%DASH $213.38 +3.76%FTNT $111.64 +1.51%CTSH $90.70 +1.25%CCEP $84.90 +2.65%

📈20th day of uptrend

Day 📈1 of current uptrend occurred on Jan. 17th 2025.

QQQ+3.15% since start of current uptrendTQQQ+8.05% since start of current uptrend

| A | B | C | D | E | F | G | |

|---|---|---|---|---|---|---|---|

|

1

|

Market Signal | Trend Count | QQQ Close | QQQ %chg since 📈1 | TQQQ close | TQQQ %chg since 📈1 | Date |

|

2

|

1 | 📈1 | $521.74 | 0.00% | $83.14 | 0.00% | Fri 1/17/25 |

|

3

|

1 | 📈2 | $524.80 | 0.59% | $84.54 | 1.68% | Tue 1/21/25 |

|

4

|

1 | 📈3 | $531.51 | 1.87% | $87.80 | 5.61% | Wed 1/22/25 |

|

5

|

1 | 📈4 | $532.64 | 2.09% | $88.34 | 6.25% | Thu 1/23/25 |

|

6

|

1 | 📈5 | $529.63 | 1.51% | $86.75 | 4.34% | Fri 1/24/25 |

|

7

|

-2 | 📈6* | $514.21 | -1.44% | $79.14 | -4.81% | Mon 1/27/25 |

|

8

|

5 | 📈7 | $521.81 | 0.01% | $82.65 | -0.59% | Tue 1/28/25 |

|

9

|

4 | 📈8 | $520.83 | -0.17% | $82.14 | -1.20% | Wed 1/29/25 |

|

10

|

4 | 📈9 | $523.05 | 0.25% | $83.17 | 0.04% | Thu 1/30/25 |

|

11

|

4 | 📈10 | $522.29 | 0.11% | $82.72 | -0.51% | Fri 1/31/25 |

|

12

|

3 | 📈11 | $518.11 | -0.70% | $80.72 | -2.91% | Mon 2/3/25 |

|

13

|

6 | 📈12 | $524.47 | 0.52% | $83.65 | 0.61% | Tue 2/4/25 |

|

14

|

6 | 📈13 | $526.85 | 0.98% | $84.74 | 1.92% | Wed 2/5/25 |

|

15

|

6 | 📈14 | $529.60 | 1.51% | $86.01 | 3.45% | Thu 2/6/25 |

|

16

|

5 | 📈15 | $522.92 | 0.23% | $82.73 | -0.49% | Fri 2/7/25 |

|

17

|

6 | 📈16 | $529.25 | 1.44% | $85.64 | 3.01% | Mon 2/10/25 |

|

18

|

5 | 📈17 | $527.99 | 1.20% | $85.03 | 2.27% | Tue 2/11/25 |

|

19

|

5 | 📈18 | $528.30 | 1.26% | $85.20 | 2.48% | Wed 2/12/25 |

|

20

|

6 | 📈19 | $535.90 | 2.71% | $88.79 | 6.80% | Thu 2/13/25 |

|

21

|

6 | 📈20 | $538.15 | 3.15% | $89.83 | 8.05% | Fri 2/14/25 |

Market Signal, Trend Count, closing prices, and return (%) over current uptrend

*Uptrend persists, as a new downtrend calls for consecutive days of negative Market Signal values, which did not occur.

TQQQ vs QQQ Holdings

TQQQ is outperforming 69% of QQQ holdings since day 📈1 of current uptrend (Jan. 17th 2025).

| A | B | C | D | E | |

|---|---|---|---|---|---|

|

1

|

Market Cap | Symbol | %Chg since 📈1 | Close on 📈1 | Close |

|

2

|

195,214 M | QQQ | 3.15% | $521.74 | $538.15 |

|

3

|

271,449 M | PLTR | 66.03% | $71.77 | $119.16 |

|

4

|

173,465 M | APP | 49.01% | $342.34 | $510.13 |

|

5

|

111,269 M | CRWD | 26.54% | $357.00 | $451.74 |

|

6

|

82,032 M | TEAM | 24.07% | $252.36 | $313.10 |

|

7

|

309,202 M | TMUS | 23.68% | $218.97 | $270.82 |

|

8

|

452,824 M | NFLX | 23.37% | $858.10 | $1,058.60 |

|

9

|

88,637 M | DASH | 22.29% | $174.48 | $213.38 |

|

10

|

1,866,471 M | META | 20.22% | $612.77 | $736.67 |

|

11

|

100,297 M | ABNB | 19.46% | $135.12 | $161.42 |

|

12

|

85,567 M | FTNT | 18.48% | $94.23 | $111.64 |

|

13

|

127,849 M | SBUX | 18.31% | $95.13 | $112.55 |

|

14

|

172,430 M | PDD | 17.61% | $105.57 | $124.16 |

|

15

|

44,862 M | CTSH | 16.57% | $77.81 | $90.70 |

|

16

|

52,113 M | AXON | 15.07% | $593.89 | $683.41 |

|

17

|

106,971 M | MELI | 14.92% | $1,836.00 | $2,109.99 |

|

18

|

23,209 M | MDB | 14.43% | $253.11 | $289.63 |

|

19

|

475,793 M | COST | 13.64% | $943.19 | $1,071.85 |

|

20

|

32,636 M | ZS | 13.39% | $187.58 | $212.70 |

|

21

|

129,711 M | GILD | 13.33% | $91.84 | $104.08 |

|

22

|

131,260 M | PANW | 12.94% | $177.11 | $200.03 |

|

23

|

36,845 M | TTWO | 11.99% | $186.41 | $208.76 |

|

24

|

228,184 M | AZN | 10.48% | $66.60 | $73.58 |

|

25

|

39,127 M | CCEP | 10.16% | $77.07 | $84.90 |

|

26

|

102,188 M | INTC | 9.82% | $21.49 | $23.60 |

|

27

|

61,504 M | ROP | 9.81% | $522.32 | $573.58 |

|

28

|

44,053 M | ODFL | 8.86% | $189.55 | $206.34 |

|

29

|

42,167 M | GEHC | 8.82% | $84.74 | $92.21 |

|

30

|

117,867 M | VRTX | 8.77% | $422.00 | $459.00 |

|

31

|

43,074 M | EXC | 8.70% | $39.42 | $42.85 |

|

32

|

25,366 M | WBD | 8.61% | $9.52 | $10.34 |

|

33

|

75,676 M | ORLY | 8.38% | $1,216.79 | $1,318.80 |

|

34

|

45,804 M | TQQQ | 8.05% | $83.14 | $89.83 |

|

35

|

258,362 M | CSCO | 7.70% | $60.23 | $64.87 |

|

36

|

200,312 M | ADBE | 7.02% | $429.99 | $460.16 |

|

37

|

156,508 M | AMGN | 7.00% | $272.11 | $291.16 |

|

38

|

168,155 M | ARM | 6.89% | $149.26 | $159.54 |

|

39

|

3,674,399 M | AAPL | 6.36% | $229.98 | $244.60 |

|

40

|

36,400 M | IDXX | 6.03% | $419.26 | $444.53 |

|

41

|

34,800 M | DXCM | 5.56% | $84.38 | $89.07 |

|

42

|

41,442 M | VRSK | 5.36% | $278.55 | $293.48 |

|

43

|

78,672 M | MDLZ | 5.12% | $57.86 | $60.82 |

|

44

|

217,604 M | LIN | 4.82% | $436.00 | $457.00 |

|

45

|

54,297 M | AEP | 4.71% | $97.25 | $101.83 |

|

46

|

190,486 M | QCOM | 4.66% | $164.56 | $172.23 |

|

47

|

57,224 M | CPRT | 4.38% | $56.90 | $59.39 |

|

48

|

56,966 M | NXPI | 4.08% | $215.36 | $224.14 |

|

49

|

125,377 M | ADP | 4.04% | $296.18 | $308.15 |

|

50

|

65,239 M | ADSK | 3.87% | $291.45 | $302.72 |

|

51

|

68,641 M | WDAY | 3.37% | $249.64 | $258.05 |

|

52

|

106,223 M | LRCX | 3.05% | $80.30 | $82.75 |

|

53

|

82,412 M | CTAS | 2.98% | $198.31 | $204.22 |

|

54

|

39,399 M | XEL | 2.83% | $66.72 | $68.61 |

|

55

|

51,140 M | CHTR | 2.53% | $351.37 | $360.27 |

|

56

|

166,953 M | BKNG | 2.39% | $4,926.80 | $5,044.40 |

|

57

|

78,165 M | MAR | 2.29% | $277.18 | $283.52 |

|

58

|

64,351 M | CSX | 1.96% | $32.73 | $33.37 |

|

59

|

2,423,489 M | AMZN | 1.21% | $225.94 | $228.68 |

|

60

|

3,400,437 M | NVDA | 0.83% | $137.71 | $138.85 |

|

61

|

53,019 M | PAYX | 0.66% | $146.29 | $147.25 |

|

62

|

212,407 M | ISRG | 0.49% | $592.64 | $595.55 |

|

63

|

25,239 M | CDW | 0.35% | $188.73 | $189.39 |

|

64

|

99,264 M | CEG | 0.30% | $316.36 | $317.30 |

|

65

|

30,362 M | CSGP | 0.28% | $73.85 | $74.06 |

|

66

|

23,853 M | GFS | 0.14% | $43.10 | $43.16 |

|

67

|

42,932 M | KDP | 0.09% | $31.62 | $31.65 |

|

68

|

45,941 M | BKR | -0.30% | $46.54 | $46.40 |

|

69

|

47,897 M | MNST | -0.34% | $49.42 | $49.25 |

|

70

|

295,510 M | ASML | -0.63% | $756.33 | $751.55 |

|

71

|

80,772 M | SNPS | -0.79% | $526.70 | $522.53 |

|

72

|

99,763 M | KLAC | -0.89% | $757.47 | $750.74 |

|

73

|

73,641 M | REGN | -1.17% | $681.58 | $673.60 |

|

74

|

34,559 M | KHC | -1.20% | $29.27 | $28.92 |

|

75

|

42,880 M | FAST | -1.71% | $76.08 | $74.78 |

|

76

|

1,092,341 M | AVGO | -1.85% | $237.44 | $233.04 |

|

77

|

44,656 M | LULU | -1.88% | $373.70 | $366.68 |

|

78

|

106,478 M | ADI | -2.08% | $219.16 | $214.61 |

|

79

|

20,102 M | BIIB | -2.29% | $140.55 | $137.33 |

|

80

|

164,418 M | INTU | -2.77% | $604.13 | $587.38 |

|

81

|

29,639 M | ANSS | -3.14% | $349.93 | $338.93 |

|

82

|

133,810 M | CMCSA | -3.25% | $36.58 | $35.39 |

|

83

|

196,659 M | PEP | -3.28% | $148.25 | $143.39 |

|

84

|

80,960 M | CDNS | -3.41% | $305.60 | $295.19 |

|

85

|

29,989 M | MCHP | -3.81% | $57.97 | $55.76 |

|

86

|

55,565 M | PCAR | -3.96% | $110.33 | $105.96 |

|

87

|

3,036,261 M | MSFT | -4.80% | $429.03 | $408.43 |

|

88

|

166,963 M | TXN | -4.88% | $192.42 | $183.03 |

|

89

|

21,842 M | ON | -5.13% | $54.63 | $51.83 |

|

90

|

44,507 M | DDOG | -5.34% | $138.40 | $131.01 |

|

91

|

2,277,945 M | GOOG | -5.41% | $197.55 | $186.87 |

|

92

|

2,257,954 M | GOOGL | -5.49% | $196.00 | $185.23 |

|

93

|

110,882 M | MU | -5.89% | $105.75 | $99.52 |

|

94

|

183,276 M | AMD | -6.88% | $121.46 | $113.10 |

|

95

|

45,781 M | ROST | -6.97% | $149.15 | $138.76 |

|

96

|

33,724 M | EA | -8.87% | $142.00 | $129.40 |

|

97

|

131,838 M | HON | -8.91% | $222.58 | $202.75 |

|

98

|

137,509 M | AMAT | -11.90% | $192.05 | $169.20 |

|

99

|

45,839 M | FANG | -12.87% | $180.18 | $156.99 |

|

100

|

92,163 M | MRVL | -14.63% | $124.76 | $106.51 |

|

101

|

87,195 M | MSTR | -14.82% | $396.50 | $337.73 |

|

102

|

77,131 M | PYPL | -15.07% | $91.81 | $77.97 |

|

103

|

1,144,565 M | TSLA | -16.57% | $426.50 | $355.84 |

|

104

|

39,565 M | TTD | -35.57% | $124.42 | $80.16 |