Dec. 27th 2024

⚠️ Cautionary signs ⚠️

Market Signal: +4 MODERATE BULLISH

The uptrend is intact but continues to wane, and the market continues to teeter. A Market Signal value of +4 teeters on the edge of neutral-to-weak bullish. A number of cautionary indications have occurred:

Consecutive Losses

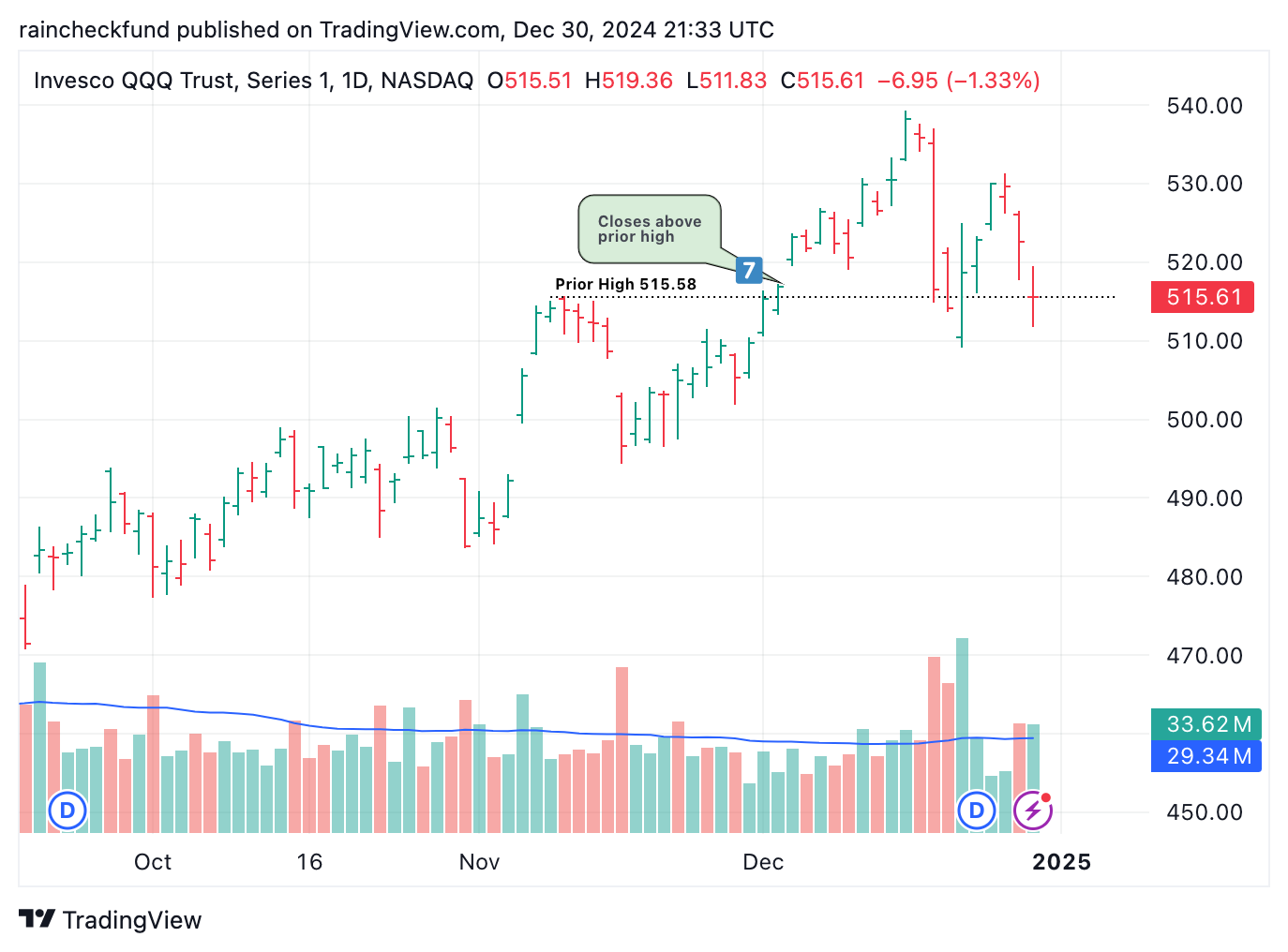

QQQgapped down on Fri. Dec. 27th 2024, and again on Mon. Dec. 30th 2024 - closing at a loss of -1.33% both days consecutively. This marks the 11th largest single day loss forQQQthroughout the current uptrend (Note: this bullet was added retroactively to this post on 12/30/24 around 8:00 AM PST).

Lack of new highs

A strong uptrend sees stocks hitting new highs. Zero NASDAQ-100 (QQQ) holdings closed at a 52-week high nor 52-week low today. This is a sign of an indecisive market.

Weakness at key levels

Note: this section was added retroactively and includes Mon. Dec. 30th 2024.

QQQ is retesting $515.58, a key level mentioned in prior post(s). Bulls want to see support at this level, but it hasn't materialized.

QQQ managed to closed just above $515.58 following the severe pullback on Wed. Dec. 18th. After that, QQQ briefly bounced up, offering hope before trending downwards again, today closing basically right at this level.

Uptrends consist of higher highs, which we are not seeing. The downward action observed over the past 8 days is a bearish indication.

NASDAQ-100 Reconstitutes

The NASDAQ-100 underwent annual reconstitution.

- Illumina, Inc. (

ILMN), Super Micro Computer, Inc. (SMCI), and Moderna, Inc. (MRNA) were removed from the index. - Palantir Technologies Inc. (

PLTR), MicroStrategy Incorporated (MSTR), and Axon Enterprise, Inc. (AXON) were added.

It's interesting to note the ascent of Bitcoin earned MicroStrategy a spot in the NASDAQ-100 (QQQ). MicroStrategy is one of few Bitcoin Treasury Companies (meaning it uses the cryptocurrency as a treasury holding instead of traditional assets), and the largest corporate holder of bitcoin. MSTR stock price often moves with the price of the cryptocurrency. If you had Bitcoin FOMO, you can rest assured knowing that investing in QQQ, and therefore TQQQ, provides some (indirect) exposure to Bitcoin.

📈94th day of uptrend

Day 📈1 of current uptrend occurred on Aug. 15 2024.

QQQ+10.15% since start of current uptrendTQQQ+23.66% since start of current uptrend

| A | B | C | D | E | F | G | |

|---|---|---|---|---|---|---|---|

|

1

|

Market Signal | Trend Count | QQQ Close | QQQ %chg since 📈1 | TQQQ close | TQQQ %chg since 📈1 | Date |

|

2

|

1 | 📈1 | $474.42 | 0.00% | $68.46 | 0.00% | Thu 8/15/24 |

|

3

|

3 | 📈2 | $475.02 | 0.13% | $68.64 | 0.26% | Fri 8/16/24 |

|

4

|

4 | 📈3 | $481.27 | 1.44% | $71.30 | 4.15% | Mon 8/19/24 |

|

5

|

3 | 📈4 | $480.26 | 1.23% | $70.86 | 3.51% | Tue 8/20/24 |

|

6

|

3 | 📈5 | $482.50 | 1.70% | $71.83 | 4.92% | Wed 8/21/24 |

|

7

|

7 | 📈6 | $474.85 | 0.09% | $68.38 | -0.12% | Thu 8/22/24 |

|

8

|

8 | 📈7 | $480.00 | 1.18% | $70.53 | 3.02% | Fri 8/23/24 |

|

9

|

7 | 📈8 | $475.34 | 0.19% | $68.46 | 0.00% | Mon 8/26/24 |

|

10

|

8 | 📈9 | $476.76 | 0.49% | $69.04 | 0.85% | Tue 8/27/24 |

|

11

|

5 | 📈10 | $471.35 | -0.65% | $66.70 | -2.57% | Wed 8/28/24 |

|

12

|

5 | 📈11 | $470.66 | -0.79% | $66.35 | -3.08% | Thu 8/29/24 |

|

13

|

7 | 📈12 | $476.27 | 0.39% | $68.61 | 0.22% | Fri 8/30/24 |

|

14

|

4 | 📈13 | $461.81 | -2.66% | $62.35 | -8.92% | Tue 9/3/24 |

|

15

|

2 | 📈14 | $460.61 | -2.91% | $61.82 | -9.70% | Wed 9/4/24 |

|

16

|

2 | 📈15 | $461.04 | -2.82% | $62.02 | -9.41% | Thu 9/5/24 |

|

17

|

1 | 📈16 | $448.69 | -5.42% | $56.99 | -16.75% | Fri 9/6/24 |

|

18

|

1 | 📈17 | $454.46 | -4.21% | $59.11 | -13.66% | Mon 9/9/24 |

|

19

|

1 | 📈18 | $458.66 | -3.32% | $60.70 | -11.34% | Tue 9/10/24 |

|

20

|

1 | 📈19 | $468.62 | -1.22% | $64.57 | -5.68% | Wed 9/11/24 |

|

21

|

5 | 📈20 | $473.22 | -0.25% | $66.48 | -2.89% | Thu 9/12/24 |

|

22

|

5 | 📈21 | $475.34 | 0.19% | $67.35 | -1.62% | Fri 9/13/24 |

|

23

|

1 | 📈22 | $473.24 | -0.25% | $66.45 | -2.94% | Mon 9/16/24 |

|

24

|

1 | 📈23 | $473.49 | -0.20% | $66.49 | -2.88% | Tue 9/17/24 |

|

25

|

3 | 📈24 | $471.44 | -0.63% | $65.62 | -4.15% | Wed 9/18/24 |

|

26

|

3 | 📈25 | $483.36 | 1.88% | $70.58 | 3.10% | Thu 9/19/24 |

|

27

|

7 | 📈26 | $482.44 | 1.69% | $70.13 | 2.44% | Fri 9/20/24 |

|

28

|

7 | 📈27 | $483.04 | 1.82% | $70.65 | 3.20% | Mon 9/23/24 |

|

29

|

7 | 📈28 | $485.37 | 2.31% | $71.65 | 4.66% | Tue 9/24/24 |

|

30

|

7 | 📈29 | $485.95 | 2.43% | $71.67 | 4.69% | Wed 9/25/24 |

|

31

|

7 | 📈30 | $489.47 | 3.17% | $73.19 | 6.91% | Thu 9/26/24 |

|

32

|

7 | 📈31 | $486.75 | 2.60% | $71.93 | 5.07% | Fri 9/27/24 |

|

33

|

7 | 📈32 | $488.07 | 2.88% | $72.49 | 5.89% | Mon 9/30/24 |

|

34

|

6 | 📈33 | $481.27 | 1.44% | $69.42 | 1.40% | Tue 10/1/24 |

|

35

|

6 | 📈34 | $481.95 | 1.59% | $69.68 | 1.78% | Wed 10/2/24 |

|

36

|

6 | 📈35 | $481.59 | 1.51% | $69.52 | 1.55% | Thu 10/3/24 |

|

37

|

7 | 📈36 | $487.32 | 2.72% | $71.97 | 5.13% | Fri 10/4/24 |

|

38

|

6 | 📈37 | $482.10 | 1.62% | $69.60 | 1.67% | Mon 10/7/24 |

|

39

|

7 | 📈38 | $489.30 | 3.14% | $72.62 | 6.08% | Tue 10/8/24 |

|

40

|

8 | 📈39 | $493.15 | 3.95% | $74.37 | 8.63% | Wed 10/9/24 |

|

41

|

8 | 📈40 | $492.59 | 3.83% | $74.11 | 8.25% | Thu 10/10/24 |

|

42

|

8 | 📈41 | $493.36 | 3.99% | $74.30 | 8.53% | Fri 10/11/24 |

|

43

|

8 | 📈42 | $497.50 | 4.86% | $76.20 | 11.31% | Mon 10/14/24 |

|

44

|

7 | 📈43 | $490.85 | 3.46% | $73.16 | 6.87% | Tue 10/15/24 |

|

45

|

8 | 📈44 | $490.91 | 3.48% | $73.12 | 6.81% | Wed 10/16/24 |

|

46

|

8 | 📈45 | $491.25 | 3.55% | $73.34 | 7.13% | Thu 10/17/24 |

|

47

|

7 | 📈46 | $494.47 | 4.23% | $74.64 | 9.03% | Fri 10/18/24 |

|

48

|

7 | 📈47 | $495.42 | 4.43% | $75.05 | 9.63% | Mon 10/21/24 |

|

49

|

7 | 📈48 | $495.96 | 4.54% | $75.27 | 9.95% | Tue 10/22/24 |

|

50

|

6 | 📈49 | $488.36 | 2.94% | $71.79 | 4.86% | Wed 10/23/24 |

|

51

|

6 | 📈50 | $492.32 | 3.77% | $71.79 | 4.86% | Thu 10/24/24 |

|

52

|

7 | 📈51 | $495.32 | 4.41% | $74.74 | 9.17% | Fri 10/25/24 |

|

53

|

7 | 📈52 | $495.40 | 4.42% | $74.81 | 9.28% | Mon 10/28/24 |

|

54

|

7 | 📈53 | $500.16 | 5.43% | $76.88 | 12.30% | Tue 10/29/24 |

|

55

|

7 | 📈54 | $496.47 | 4.65% | $75.14 | 9.76% | Wed 10/30/24 |

|

56

|

5 | 📈55 | $483.85 | 1.99% | $69.45 | 1.45% | Thu 10/31/24 |

|

57

|

3 | 📈56 | $487.43 | 2.74% | $70.97 | 3.67% | Fri 11/1/24 |

|

58

|

5 | 📈57 | $486.01 | 2.44% | $70.27 | 2.64% | Mon 11/4/24 |

|

59

|

7 | 📈58 | $492.21 | 3.75% | $72.94 | 6.54% | Tue 11/5/24 |

|

60

|

8 | 📈59 | $505.58 | 6.57% | $78.86 | 15.19% | Wed 11/6/24 |

|

61

|

8 | 📈60 | $513.54 | 8.25% | $82.55 | 20.58% | Thu 11/7/24 |

|

62

|

7 | 📈61 | $514.14 | 8.37% | $82.75 | 20.87% | Fri 11/8/24 |

|

63

|

8 | 📈62 | $513.84 | 8.31% | $82.60 | 20.65% | Mon 11/11/24 |

|

64

|

8 | 📈63 | $512.91 | 8.11% | $82.15 | 20.00% | Tue 11/12/24 |

|

65

|

8 | 📈64 | $512.25 | 7.97% | $81.79 | 19.47% | Wed 11/13/24 |

|

66

|

8 | 📈65 | $508.69 | 7.09% | $80.06 | 16.64% | Thu 11/14/24 |

|

67

|

5 | 📈66 | $496.57 | 4.67% | $74.27 | 8.49% | Fri 11/15/24 |

|

68

|

6 | 📈67 | $500.02 | 5.40% | $75.77 | 10.68% | Mon 11/18/24 |

|

69

|

6 | 📈68 | $503.46 | 6.12% | $77.29 | 12.90% | Tue 11/19/24 |

|

70

|

7 | 📈69 | $503.17 | 6.06% | $77.20 | 12.77% | Wed 11/20/24 |

|

71

|

7 | 📈70 | $504.98 | 6.44% | $77.96 | 13.88% | Thu 11/21/24 |

|

72

|

7 | 📈71 | $505.79 | 6.61% | $78.25 | 14.30% | Fri 11/22/24 |

|

73

|

8 | 📈72 | $506.59 | 6.78% | $78.61 | 14.83% | Mon 11/25/24 |

|

74

|

8 | 📈73 | $509.31 | 7.35% | $79.83 | 16.61% | Tue 11/26/24 |

|

75

|

7 | 📈74 | $505.30 | 6.51% | $77.90 | 13.79% | Wed 11/27/24 |

|

76

|

7 | 📈75 | $509.74 | 7.44% | $79.89 | 16.70% | Fri 11/29/24 |

|

77

|

8 | 📈76 | $515.29 | 8.61% | $82.48 | 20.48% | Mon 12/2/24 |

|

78

|

7 | 📈77 | $516.87 | 8.95% | $83.21 | 21.55% | Tue 12/3/24 |

|

79

|

8 | 📈78 | $523.26 | 10.29% | $86.25 | 25.99% | Wed 12/4/24 |

|

80

|

8 | 📈79 | $521.81 | 9.99% | $85.54 | 24.95% | Thu 12/5/24 |

|

81

|

8 | 📈80 | $526.48 | 10.97% | $87.74 | 28.16% | Fri 12/6/24 |

|

82

|

7 | 📈81 | $522.38 | 10.11% | $85.69 | 25.17% | Mon 12/9/24 |

|

83

|

7 | 📈82 | $520.60 | 9.73% | $84.76 | 23.81% | Tue 12/10/24 |

|

84

|

8 | 📈83 | $529.92 | 11.70% | $89.29 | 30.43% | Wed 12/11/24 |

|

85

|

7 | 📈84 | $526.50 | 10.98% | $87.52 | 27.84% | Thu 12/12/24 |

|

86

|

7 | 📈85 | $530.53 | 11.83% | $89.40 | 30.59% | Fri 12/13/24 |

|

87

|

7 | 📈86 | $538.17 | 13.44% | $93.29 | 36.27% | Mon 12/16/24 |

|

88

|

7 | 📈87 | $535.80 | 12.94% | $92.04 | 34.44% | Tue 12/17/24 |

|

89

|

3 | 📈88 | $516.47 | 8.86% | $82.09 | 19.91% | Wed 12/18/24 |

|

90

|

3 | 📈89 | $514.17 | 8.38% | $80.93 | 18.22% | Thu 12/19/24 |

|

91

|

4 | 📈90 | $518.66 | 9.33% | $83.03 | 21.28% | Fri 12/20/24 |

|

92

|

4 | 📈91 | $522.87 | 10.21% | $85.06 | 24.25% | Mon 12/23/24 |

|

93

|

5 | 📈92 | $529.96 | 11.71% | $88.44 | 29.18% | Tue 12/24/24 |

|

94

|

5 | 📈93 | $529.60 | 11.63% | $88.25 | 28.91% | Thu 12/26/24 |

|

95

|

4 | 📈94 | $522.56 | 10.15% | $84.66 | 23.66% | Fri 12/27/24 |

Market Signal, Trend Count, closing prices, and return (%) over current uptrend

TQQQ vs QQQ Holdings

TQQQ is outperforming 79% of QQQ holdings since day 📈1 of current uptrend (Aug. 15 2024).

Despite the pain of the recent market weakness, TQQQ is still outperforming nearly 8 in 10 NASDAQ-100 stocks since the start of current uptrend.

| A | B | C | D | E | |

|---|---|---|---|---|---|

|

1

|

Market Cap | Symbol | %Chg since 📈1 | Close on 📈1 | Close |

|

2

|

189,559 M | QQQ | 10.15% | $474.42 | $522.56 |

|

3

|

112,480 M | APP | 291.65% | $85.58 | $335.17 |

|

4

|

175,867 M | PLTR | 153.30% | $31.22 | $79.08 |

|

5

|

74,381 M | MSTR | 150.13% | $131.93 | $330.00 |

|

6

|

1,385,654 M | TSLA | 101.58% | $214.14 | $431.66 |

|

7

|

65,137 M | TEAM | 70.34% | $146.83 | $250.11 |

|

8

|

98,315 M | MRVL | 63.88% | $69.33 | $113.62 |

|

9

|

45,164 M | AXON | 63.50% | $373.69 | $610.98 |

|

10

|

47,090 M | LULU | 50.72% | $256.55 | $386.67 |

|

11

|

26,028 M | WBD | 46.55% | $7.24 | $10.61 |

|

12

|

1,133,168 M | AVGO | 45.52% | $166.13 | $241.75 |

|

13

|

166,721 M | BKNG | 38.59% | $3,634.67 | $5,037.39 |

|

14

|

387,940 M | NFLX | 36.84% | $663.22 | $907.55 |

|

15

|

87,438 M | CRWD | 36.28% | $260.49 | $354.99 |

|

16

|

73,641 M | FTNT | 30.90% | $73.40 | $96.08 |

|

17

|

70,343 M | DASH | 29.97% | $130.29 | $169.34 |

|

18

|

87,081 M | PYPL | 27.85% | $67.94 | $86.86 |

|

19

|

78,827 M | MAR | 27.83% | $221.90 | $283.66 |

|

20

|

32,742 M | TTWO | 27.36% | $146.38 | $186.43 |

|

21

|

117,286 M | GILD | 26.59% | $74.34 | $94.11 |

|

22

|

2,352,734 M | AMZN | 25.99% | $177.59 | $223.75 |

|

23

|

49,596 M | DDOG | 25.50% | $116.33 | $145.99 |

|

24

|

43,168 M | TQQQ | 23.66% | $68.46 | $84.66 |

|

25

|

237,412 M | CSCO | 22.83% | $48.53 | $59.61 |

|

26

|

59,915 M | TTD | 20.79% | $100.50 | $121.39 |

|

27

|

2,359,575 M | GOOGL | 19.50% | $161.30 | $192.76 |

|

28

|

70,854 M | CEG | 18.99% | $190.39 | $226.54 |

|

29

|

64,133 M | ADSK | 18.94% | $250.21 | $297.59 |

|

30

|

2,375,244 M | GOOG | 18.92% | $163.17 | $194.04 |

|

31

|

40,373 M | BKR | 16.31% | $35.08 | $40.80 |

|

32

|

39,129 M | XEL | 15.69% | $58.90 | $68.14 |

|

33

|

149,238 M | HON | 15.65% | $198.46 | $229.51 |

|

34

|

70,820 M | WDAY | 14.98% | $231.56 | $266.24 |

|

35

|

258,812 M | TMUS | 14.59% | $194.63 | $223.02 |

|

36

|

3,863,453 M | AAPL | 13.74% | $224.72 | $255.59 |

|

37

|

54,826 M | PCAR | 13.65% | $92.01 | $104.57 |

|

38

|

56,328 M | CPRT | 13.29% | $51.60 | $58.46 |

|

39

|

120,681 M | ADP | 12.33% | $263.66 | $296.18 |

|

40

|

50,866 M | PAYX | 12.28% | $125.82 | $141.27 |

|

41

|

83,335 M | ABNB | 12.20% | $118.88 | $133.39 |

|

42

|

51,106 M | MNST | 11.83% | $46.99 | $52.55 |

|

43

|

1,514,213 M | META | 11.63% | $537.33 | $599.81 |

|

44

|

3,355,375 M | NVDA | 11.52% | $122.86 | $137.01 |

|

45

|

190,513 M | ISRG | 11.39% | $480.17 | $534.88 |

|

46

|

31,341 M | DXCM | 10.89% | $72.36 | $80.24 |

|

47

|

41,829 M | FAST | 9.58% | $66.63 | $73.02 |

|

48

|

83,658 M | CDNS | 8.89% | $280.12 | $305.03 |

|

49

|

122,171 M | PANW | 8.47% | $171.64 | $186.18 |

|

50

|

69,124 M | ORLY | 7.30% | $1,115.89 | $1,197.35 |

|

51

|

417,132 M | COST | 7.11% | $877.35 | $939.70 |

|

52

|

39,269 M | CTSH | 4.94% | $75.47 | $79.20 |

|

53

|

29,707 M | ANSS | 4.52% | $325.00 | $339.71 |

|

54

|

39,158 M | VRSK | 4.19% | $266.14 | $277.30 |

|

55

|

50,466 M | ROST | 3.49% | $147.80 | $152.96 |

|

56

|

3,200,939 M | MSFT | 2.26% | $421.03 | $430.53 |

|

57

|

38,848 M | EA | 0.73% | $147.04 | $148.12 |

|

58

|

37,611 M | EXC | -0.19% | $37.50 | $37.43 |

|

59

|

35,253 M | CCEP | -0.39% | $76.78 | $76.48 |

|

60

|

135,789 M | ARM | -0.95% | $130.44 | $129.20 |

|

61

|

49,572 M | CHTR | -0.95% | $352.01 | $348.65 |

|

62

|

87,554 M | INTC | -1.88% | $20.69 | $20.30 |

|

63

|

178,746 M | INTU | -2.08% | $652.14 | $638.57 |

|

64

|

24,416 M | GFS | -2.75% | $45.43 | $44.18 |

|

65

|

104,593 M | SBUX | -2.77% | $94.88 | $92.25 |

|

66

|

107,691 M | ADI | -2.99% | $223.67 | $216.99 |

|

67

|

28,319 M | ZS | -3.04% | $190.34 | $184.56 |

|

68

|

29,607 M | CSGP | -3.13% | $74.55 | $72.22 |

|

69

|

62,596 M | CSX | -3.48% | $33.63 | $32.46 |

|

70

|

145,141 M | CMCSA | -4.02% | $39.52 | $37.93 |

|

71

|

56,178 M | ROP | -4.15% | $546.57 | $523.91 |

|

72

|

49,268 M | AEP | -4.19% | $96.56 | $92.51 |

|

73

|

19,100 M | MDB | -4.30% | $249.05 | $238.35 |

|

74

|

73,989 M | CTAS | -4.46% | $191.94 | $183.37 |

|

75

|

174,398 M | TXN | -5.32% | $201.93 | $191.18 |

|

76

|

36,326 M | GEHC | -6.79% | $85.30 | $79.51 |

|

77

|

201,405 M | LIN | -7.27% | $456.14 | $422.98 |

|

78

|

38,479 M | ODFL | -8.58% | $197.14 | $180.23 |

|

79

|

43,773 M | KDP | -8.66% | $35.33 | $32.27 |

|

80

|

174,694 M | QCOM | -9.29% | $173.34 | $157.24 |

|

81

|

37,097 M | KHC | -10.27% | $34.19 | $30.68 |

|

82

|

75,884 M | SNPS | -10.46% | $548.28 | $490.91 |

|

83

|

209,763 M | PEP | -11.38% | $172.52 | $152.89 |

|

84

|

28,107 M | ON | -13.01% | $75.88 | $66.01 |

|

85

|

105,268 M | VRTX | -13.40% | $472.00 | $408.76 |

|

86

|

87,477 M | MELI | -13.57% | $1,996.44 | $1,725.47 |

|

87

|

80,512 M | MDLZ | -14.33% | $70.28 | $60.21 |

|

88

|

33,976 M | IDXX | -14.54% | $485.52 | $414.93 |

|

89

|

203,159 M | AMD | -15.04% | $147.36 | $125.19 |

|

90

|

54,328 M | NXPI | -15.59% | $253.25 | $213.76 |

|

91

|

98,749 M | MU | -17.13% | $106.95 | $88.63 |

|

92

|

94,443 M | LRCX | -17.54% | $89.01 | $73.40 |

|

93

|

141,183 M | AMGN | -19.28% | $325.39 | $262.65 |

|

94

|

196,540 M | ADBE | -19.43% | $554.16 | $446.48 |

|

95

|

46,234 M | FANG | -19.45% | $196.58 | $158.34 |

|

96

|

23,429 M | CDW | -20.76% | $221.87 | $175.81 |

|

97

|

135,747 M | AMAT | -21.24% | $211.83 | $166.83 |

|

98

|

205,448 M | AZN | -21.96% | $84.90 | $66.26 |

|

99

|

86,250 M | KLAC | -22.89% | $836.19 | $644.81 |

|

100

|

280,584 M | ASML | -23.13% | $928.25 | $713.59 |

|

101

|

22,049 M | BIIB | -24.96% | $201.63 | $151.31 |

|

102

|

31,329 M | MCHP | -28.24% | $81.30 | $58.34 |

|

103

|

135,336 M | PDD | -32.83% | $145.08 | $97.45 |

|

104

|

78,285 M | REGN | -39.39% | $1,175.33 | $712.40 |